Compare Aeroflex with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Poor long term growth as Net Sales has grown by an annual rate of 14.65% and Operating profit at 5.12% over the last 5 years

Positive results in Dec 25

With ROE of 13.3, it has a Very Expensive valuation with a 6.2 Price to Book Value

Increasing Participation by Institutional Investors

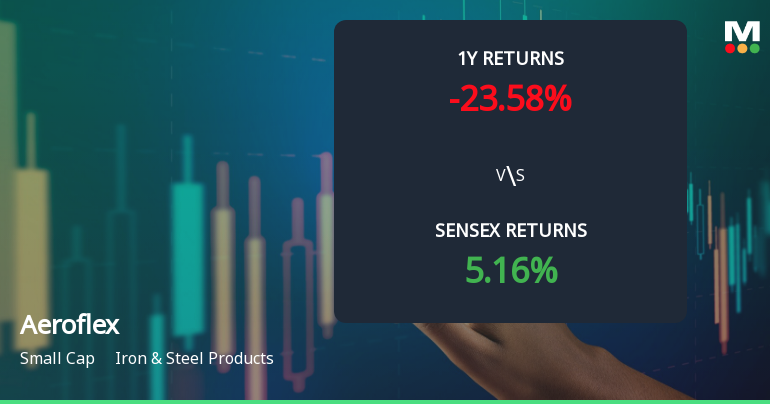

Below par performance in long term as well as near term

Stock DNA

Iron & Steel Products

INR 2,216 Cr (Small Cap)

45.00

28

0.17%

-0.05

13.29%

6.32

Total Returns (Price + Dividend)

Latest dividend: 0.3 per share ex-dividend date: Jul-29-2025

Risk Adjusted Returns v/s

Returns Beta

News

Aeroflex Industries Ltd Upgraded to Hold as Financials Improve Amid Mixed Technical Signals

Aeroflex Industries Ltd, a player in the Iron & Steel Products sector, has seen its investment rating upgraded from Sell to Hold as of 30 January 2026. This change reflects a combination of improved financial performance, evolving technical indicators, and valuation considerations amid a challenging market backdrop. The company’s recent quarterly results and shifting market dynamics have prompted analysts to reassess its outlook, balancing positive operational metrics against valuation concerns and subdued long-term growth.

Read full news article

Aeroflex Industries Ltd Technical Momentum Shifts Amid Mixed Market Signals

Aeroflex Industries Ltd, a key player in the Iron & Steel Products sector, has experienced a notable shift in its technical momentum, moving from a mildly bullish stance to a sideways trend. This transition is reflected in a mixed set of technical indicators, including MACD, RSI, Bollinger Bands, and moving averages, signalling a period of consolidation after recent volatility. Investors should carefully analyse these developments in the context of the company’s recent price action and broader market performance.

Read full news article

Aeroflex Industries Ltd is Rated Hold

Aeroflex Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 30 January 2026. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Corporate Actions

(03 Feb 2026)

Aeroflex Industries Ltd has declared 15% dividend, ex-date: 29 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (2.21%)

Held by 16 FIIs (0.99%)

Aeroflex Enterprises Limited (61.23%)

Ashish Kacholia (2.01%)

22.57%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 9.04% vs 31.47% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 15.88% vs 98.47% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.67% vs 10.62% in Sep 2024

Growth in half year ended Sep 2025 is -17.91% vs 15.05% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.09% vs 18.49% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -8.21% vs 30.22% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 18.34% vs 17.98% in Mar 2024

YoY Growth in year ended Mar 2025 is 25.83% vs 38.41% in Mar 2024