Compare Alacrity Sec. with Similar Stocks

Dashboard

Negative results in Dec 25

- NET SALES(Q) At Rs 112.50 cr has Fallen at -29.76%

- PBT LESS OI(Q) At Rs 2.73 cr has Fallen at -73.83%

- PAT(Q) At Rs 2.14 cr has Fallen at -69.4%

With ROE of 6.2, it has a Expensive valuation with a 2.5 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Non Banking Financial Company (NBFC)

INR 268 Cr (Micro Cap)

40.00

21

0.00%

0.03

6.15%

2.46

Total Returns (Price + Dividend)

Alacrity Sec. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Alacrity Securities Ltd is Rated Strong Sell

Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 March 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Alacrity Securities Ltd is Rated Strong Sell

Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 March 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 17 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

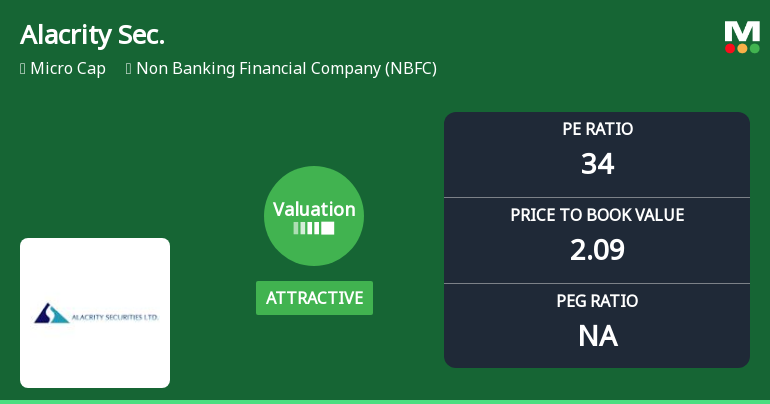

Alacrity Securities Ltd Valuation Shifts to Attractive Amid Market Pressure

Alacrity Securities Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, has seen a notable shift in its valuation parameters, moving from fair to attractive territory. Despite a recent sharp decline in share price, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now present a compelling case for investors seeking value in a turbulent NBFC landscape.

Read full news article Announcements

Clarification sought from Alacrity Securities Ltd

23-Feb-2026 | Source : BSEThe Exchange has sought clarification from Alacrity Securities Ltd on February 23 2026 with reference to significant movement in price in order to ensure that investors have latest relevant information about the company and to inform the market so that the interest of the investors is safeguarded.

The reply is awaited.

Announcement under Regulation 30 (LODR)-Newspaper Publication

30-Jan-2026 | Source : BSENewspaper Advertisement of Un audited Financial Results for the quarter ended December 31 2025.

Board Meeting Outcome for Outcome Of Board Meeting Held On Thursday January 29 2026 At 3:00 P.M.

29-Jan-2026 | Source : BSEStandalone Un-Audited Financial Results of the Company for the quarter ended on December 31 2025 along with Limited Review Report.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Pooja Ashutosh Gupta (23.2%)

Aroma Coffees Private Limited (4.29%)

34.29%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -29.76% vs 70.21% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -69.43% vs 96.08% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -46.80% vs 50.55% in Sep 2024

Growth in half year ended Sep 2025 is 3.78% vs 138.92% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -6.06% vs 49.15% in Jun 2024

YoY Growth in nine months ended Dec 2025 is 57.64% vs 101.62% in Jun 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 67.99% vs 64.47% in Mar 2024

YoY Growth in year ended Mar 2025 is 5.24% vs 254.49% in Mar 2024