Compare Alkyl Amines with Similar Stocks

Stock DNA

Specialty Chemicals

INR 7,853 Cr (Small Cap)

44.00

39

0.00%

-0.11

12.52%

5.49

Total Returns (Price + Dividend)

Latest dividend: 10 per share ex-dividend date: Jun-25-2024

Risk Adjusted Returns v/s

Returns Beta

News

Alkyl Amines Chemicals Ltd is Rated Sell

Alkyl Amines Chemicals Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 10 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Alkyl Amines Chemicals Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

Alkyl Amines Chemicals Ltd has experienced a notable shift in its technical parameters, reflecting a complex interplay of bullish and bearish signals. Despite a 3.77% gain on the day, the stock’s overall momentum and technical indicators present a nuanced picture, prompting a reassessment of its near-term outlook within the specialty chemicals sector.

Read full news article

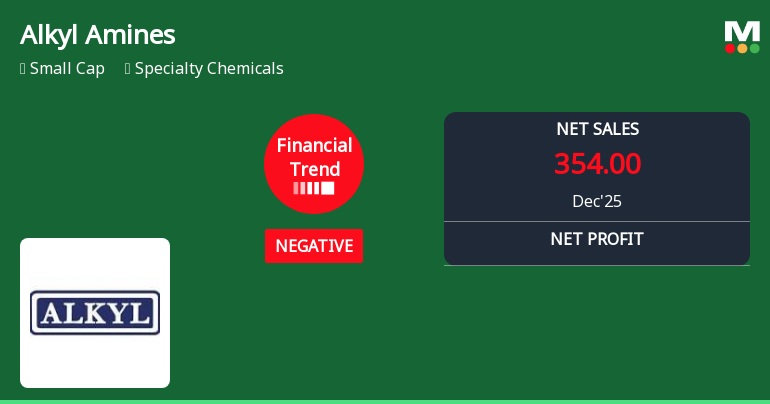

Alkyl Amines Chemicals Ltd Reports Declining Quarterly Performance Amid Negative Financial Trend

Alkyl Amines Chemicals Ltd, a key player in the specialty chemicals sector, has reported a disappointing quarterly performance for December 2025, marking a clear shift from a previously flat financial trend to a negative trajectory. The company’s latest results reveal significant contractions in revenue, profitability, and earnings per share, raising concerns about its near-term outlook despite recent stock price gains.

Read full news article Announcements

Opening Of Trading Window

04-Feb-2026 | Source : BSEAs per attachment

Results - December 2025

03-Feb-2026 | Source : BSEAs per attachment

Board Meeting Outcome for Results - December 2025

03-Feb-2026 | Source : BSEAs per attachment

Corporate Actions

No Upcoming Board Meetings

Alkyl Amines Chemicals Ltd has declared 500% dividend, ex-date: 25 Jun 24

Alkyl Amines Chemicals Ltd has announced 2:5 stock split, ex-date: 11 May 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 18 Schemes (1.35%)

Held by 86 FIIs (3.46%)

Yogesh Mathradas Kothari (57.62%)

Ikigai Emerging Equity Fund (1.54%)

17.3%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -9.09% vs -3.98% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -1.58% vs -13.15% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -2.41% vs 6.91% in Sep 2024

Growth in half year ended Sep 2025 is -4.10% vs 25.09% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -3.11% vs 9.39% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -3.89% vs 26.85% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.11% vs -14.40% in Mar 2024

YoY Growth in year ended Mar 2025 is 25.02% vs -34.89% in Mar 2024