Compare Art Nirman Ltd with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -26.70% CAGR growth in Net Sales over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.21

- The company has been able to generate a Return on Equity (avg) of 2.64% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

With ROCE of 5.5, it has a Very Expensive valuation with a 2.3 Enterprise value to Capital Employed

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Art Nirman Ltd for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Art Nirman Ltd is Rated Strong Sell

Art Nirman Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 December 2025, reflecting a reassessment of the company’s outlook. However, the analysis and financial metrics discussed below are based on the stock’s current position as of 29 January 2026, providing investors with the most up-to-date perspective on the company’s performance and prospects.

Read full news article

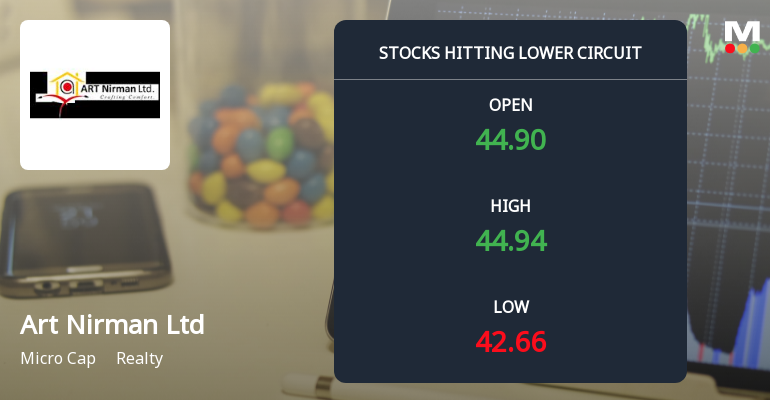

Art Nirman Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Art Nirman Ltd, a micro-cap player in the realty sector, plunged to their lower circuit limit on 20 Jan 2026, reflecting intense selling pressure and panic among investors. The stock closed at ₹42.66, down 4.99% on the day, marking its maximum permissible daily loss and underscoring the challenges facing the company amid subdued market sentiment.

Read full news article

Art Nirman Ltd is Rated Strong Sell

Art Nirman Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 December 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial data presented here are current as of 06 January 2026, providing investors with the latest perspective on the company’s performance and prospects.

Read full news article Announcements

Art Nirman Limited - Outcome of Board Meeting

14-Nov-2019 | Source : NSEArt Nirman Limited has informed the Exchange regarding Board meeting held on November 13, 2019 for the approval of financial results for half year ended on 30th September, 2019.

Art Nirman Limited - Shareholders meeting

26-Sep-2019 | Source : NSEArt Nirman Limited has informed the Exchange regarding Proceedings of Annual General Meeting held on September 26, 2019

Art Nirman Limited - Trading Window

25-Sep-2019 | Source : NSEArt Nirman Limited has informed the Exchange regarding the Trading Window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations, 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ashokkumar Raghuram Thakker (66.75%)

Ajaykumar Jamnalal Pujara (3.43%)

22.36%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -20.21% vs -29.21% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -18.87% vs -20.90% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -40.90% vs -18.65% in Sep 2024

Growth in half year ended Sep 2025 is -61.70% vs 9.30% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -11.72% vs 160.07% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 29.79% vs 435.71% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -20.12% vs 73.88% in Mar 2024

YoY Growth in year ended Mar 2025 is 68.64% vs 972.73% in Mar 2024