Dashboard

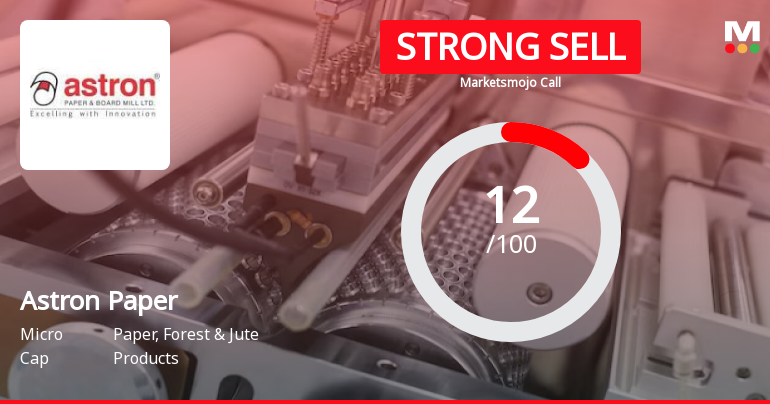

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.46

- The company has been able to generate a Return on Equity (avg) of 1.44% signifying low profitability per unit of shareholders funds

Flat results in Jan 70

Risky - Negative EBITDA

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Paper, Forest & Jute Products

INR 30 Cr (Micro Cap)

NA (Loss Making)

18

0.00%

0.94

-64.52%

0.36

Total Returns (Price + Dividend)

Astron Paper for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Astron Paper & Board Mill Hits Lower Circuit Amid Heavy Selling Pressure

Astron Paper & Board Mill Ltd witnessed a sharp decline on 11 Dec 2025, hitting its lower circuit limit as intense selling pressure gripped the stock. The micro-cap company, operating in the Paper, Forest & Jute Products sector, recorded its maximum daily loss amid a notable drop in investor participation and unfilled supply, signalling a challenging trading session.

Read More

Astron Paper Sees Revision in Market Evaluation Amidst Challenging Fundamentals

Astron Paper has experienced a revision in its market evaluation reflecting ongoing challenges in its financial and operational metrics. The stock’s recent performance and fundamental indicators highlight a cautious outlook within the Paper, Forest & Jute Products sector.

Read More

Astron Paper & Board Mill Hits Lower Circuit Amid Heavy Selling Pressure

Astron Paper & Board Mill Ltd witnessed a sharp decline on 8 December 2025, hitting its lower circuit limit as intense selling pressure gripped the stock. The micro-cap company, operating in the Paper, Forest & Jute Products sector, saw its share price fall close to its 52-week low, reflecting a day marked by panic selling and unfilled supply on the bourses.

Read More Announcements

Announcement under Regulation 30 (LODR)-Resignation of Statutory Auditors

20-Nov-2025 | Source : BSEResignation of M/s SNDK & Associates & LLP as Statutory Auditor of the Company w.e.f. 14.11.2025.

Board Meeting Outcome for Outcome Of Board Meeting

17-Nov-2025 | Source : BSEOutcome of Board Meeting and unaudited financial results for the Second quarter and half year ended on 30 th September 2025

Results For The Quarter And Half Year Ended On 30Th September 2025

17-Nov-2025 | Source : BSEApproval of Unaudited financial results for the Second quarter and half year ended on 30th September 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Kiritbhai Ghanshyambhai Patel (15.21%)

Dwarkesh Finance Limited (14.63%)

43.87%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -100.00% vs -55.93% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 40.03% vs -377.11% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -98.64% vs -40.92% in Sep 2024

Growth in half year ended Sep 2025 is 42.51% vs -392.37% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -58.97% vs -23.35% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -793.31% vs 77.48% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -69.04% vs -21.27% in Mar 2024

YoY Growth in year ended Mar 2025 is -405.89% vs 53.19% in Mar 2024