Compare Aurum Proptech with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 0%

- Poor long term growth as Net Sales has grown by an annual rate of -10.64% and Operating profit at -183.25% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -5.40

Risky - Negative Operating Profits

Despite the size of the company, domestic mutual funds hold only 0% of the company

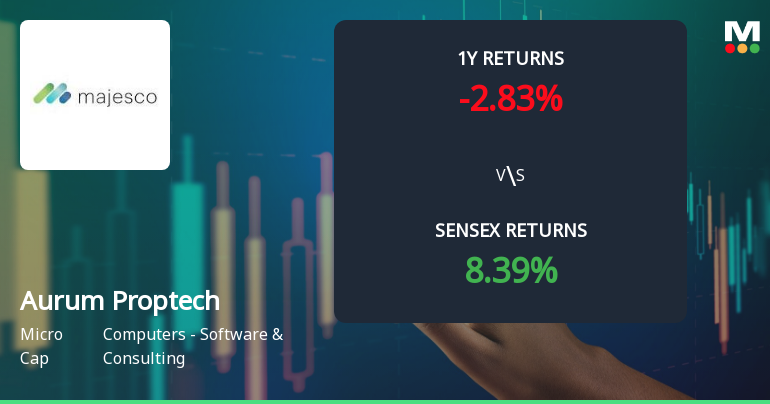

Underperformed the market in the last 1 year

Stock DNA

Computers - Software & Consulting

INR 1,244 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.25

-6.00%

2.49

Total Returns (Price + Dividend)

Latest dividend: 974 per share ex-dividend date: Dec-23-2020

Risk Adjusted Returns v/s

Returns Beta

News

Aurum Proptech Ltd Technical Momentum Shifts Amid Mixed Market Signals

Aurum Proptech Ltd has experienced a notable shift in its technical momentum, transitioning from a mildly bearish trend to a sideways movement, reflecting a complex interplay of technical indicators. Despite some mildly bullish signals on shorter timeframes, the overall technical outlook remains cautious, with key indicators such as MACD and Bollinger Bands signalling bearish tendencies. This article provides a comprehensive analysis of Aurum Proptech’s recent price action, technical indicator signals, and comparative performance against the Sensex benchmark.

Read full news article

Aurum Proptech Ltd Faces Technical Momentum Shift Amid Bearish Signals

Aurum Proptech Ltd, a player in the Computers - Software & Consulting sector, has experienced a notable shift in its technical momentum, moving from a mildly bullish stance to a mildly bearish outlook. This transition is underscored by a combination of bearish signals from key technical indicators such as the MACD, Bollinger Bands, and Dow Theory, alongside mixed readings from moving averages and momentum oscillators. The stock’s recent price action and technical metrics suggest caution for investors amid a challenging market environment.

Read full news article

Aurum Proptech Ltd Downgraded to Strong Sell Amid Technical and Fundamental Concerns

Aurum Proptech Ltd, a player in the Computers - Software & Consulting sector, has seen its investment rating downgraded from Sell to Strong Sell as of 2 March 2026. This shift reflects a combination of deteriorating technical indicators, weak long-term financial trends, challenging valuation metrics, and concerns over the company’s overall quality. The downgrade comes despite some positive quarterly financial results, underscoring the complex outlook investors face with this stock.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Restructuring

02-Mar-2026 | Source : BSEIntimation of plan of Merger of Wholly-Owned Subsidiaries.

Announcement under Regulation 30 (LODR)-Newspaper Publication

21-Feb-2026 | Source : BSEPublication of Notice to the shareholders of the Company regarding Transfer of Shares to IEPF Authority.

Announcement under Regulation 30 (LODR)-Monitoring Agency Report

13-Feb-2026 | Source : BSEMonitoring Agency Report for the quarter ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Aurum Proptech Ltd has declared 19480% dividend, ex-date: 23 Dec 20

No Splits history available

No Bonus history available

Aurum Proptech Ltd has announced 3:2 rights issue, ex-date: 12 Apr 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 3 Schemes (0.0%)

Held by 7 FIIs (0.12%)

Aurum Realestate Developers Limited (47.37%)

Rea India Pte. Ltd. (5.54%)

31.86%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 39.18% vs 20.61% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 138.08% vs 9.13% in Sep 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 23.26% vs 68.72% in Mar 2024

YoY Growth in year ended Mar 2025 is 37.48% vs -63.65% in Mar 2024