Compare Automotive Stamp with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 7.08 times)- the company has a Weak Long Term Fundamental Strength

- High Debt Company with a Debt to Equity ratio (avg) at 4.37 times

With ROCE of 22, it has a Expensive valuation with a 6.4 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0% of the company

Below par performance in long term as well as near term

Stock DNA

Auto Components & Equipments

INR 708 Cr (Micro Cap)

34.00

38

0.00%

7.08

129.49%

45.36

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Jul-12-2012

Risk Adjusted Returns v/s

Returns Beta

News

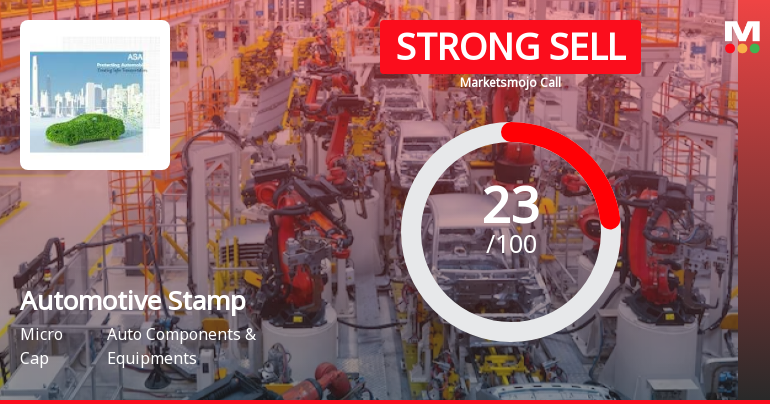

Automotive Stampings & Assemblies Ltd is Rated Strong Sell

Automotive Stampings & Assemblies Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 December 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleAre Automotive Stampings & Assemblies Ltd latest results good or bad?

Automotive Stampings & Assemblies Ltd (ASAL) has reported its Q3 FY26 results, showcasing significant operational improvements. The company achieved a net profit of ₹7.47 crores, marking a substantial increase compared to the previous quarter's profit of ₹4.39 crores. This represents the highest quarterly profit in its recent history. Revenue for the quarter reached ₹250.13 crores, reflecting a year-on-year growth of 26.23% and an 18.11% sequential increase, indicating robust demand and effective order book execution. The operating margin improved to 6.78%, the highest in seven quarters, compared to 5.82% in the same quarter last year. This enhancement in profitability metrics demonstrates improved operational efficiency and cost management. Additionally, the return on equity (ROE) surged to 97.91%, highlighting effective capital utilization and a turnaround from previous losses. Despite these positive op...

Read full news article

Automotive Stampings & Assemblies Q3 FY26: Stellar Quarter Masks Structural Concerns

Automotive Stampings and Assemblies Ltd. (ASAL), a Tata AutoComp Systems subsidiary specialising in sheet metal stampings and welded assemblies for the automotive industry, reported a remarkable turnaround in Q3 FY26, with net profit surging to ₹7.47 crores—up 70.16% quarter-on-quarter and 109.24% year-on-year. However, the stock's bearish technical trend and concerning debt profile continue to weigh on investor sentiment, with shares trading at ₹483.15 as of January 29, 2026, down 11.45% over the past year despite the strong quarterly performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

30-Jan-2026 | Source : BSENewspaper Publication of Financial Results for the quarter and nine months ended December 31 2025. Kindly take on records.

Financial Results For Quarter And Nine Months Ended December 31 2025

28-Jan-2026 | Source : BSEOutcome of the Board Meeting held on January 28 2026 for approval of Unaudited Financial Results for quarter and nine months ended December 31 2025. Kindly take on records.

Announcement under Regulation 30 (LODR)-Change in Management

28-Jan-2026 | Source : BSERe-appointment of Mr. Prakash Gurav Non Executive Independent Director for a second consecutive term. Kindly take on records.

Corporate Actions

No Upcoming Board Meetings

Automotive Stampings & Assemblies Ltd has declared 15% dividend, ex-date: 12 Jul 12

No Splits history available

No Bonus history available

Automotive Stampings & Assemblies Ltd has announced 5:9 rights issue, ex-date: 09 Jun 11

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 2 FIIs (0.0%)

Tata Autocomp Systems Limited (75.0%)

None

22.25%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 26.23% vs -8.45% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 109.24% vs -24.68% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -1.08% vs -9.82% in Sep 2024

Growth in half year ended Sep 2025 is -16.30% vs 6.02% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.14% vs -9.36% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 21.52% vs -5.58% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -11.93% vs 6.29% in Mar 2024

YoY Growth in year ended Mar 2025 is -16.81% vs 142.14% in Mar 2024