Compare AWFIS Space with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROCE of 7.30%

- The company has been able to generate a Return on Capital Employed (avg) of 7.30% signifying low profitability per unit of total capital (equity and debt)

High Debt Company with a Debt to Equity ratio (avg) at 2.37 times

With ROCE of 7.8, it has a Expensive valuation with a 2.2 Enterprise value to Capital Employed

Below par performance in long term as well as near term

Stock DNA

Diversified Commercial Services

INR 2,805 Cr (Small Cap)

54.00

34

0.00%

2.76

10.28%

5.61

Total Returns (Price + Dividend)

AWFIS Space for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

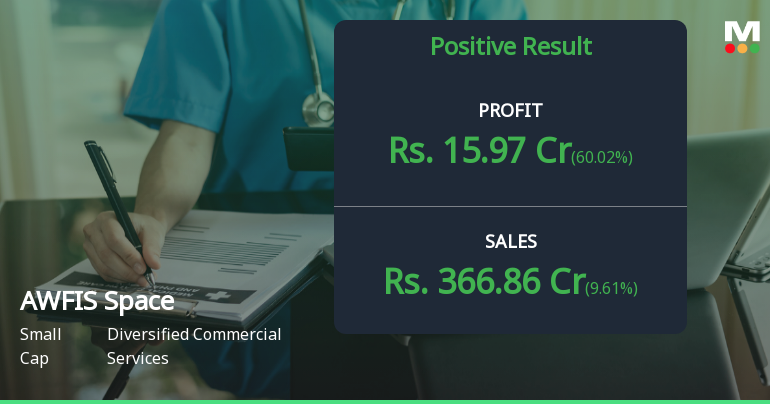

AWFIS Space Solutions Q3 FY26: Profitability Rebounds Sharply Amid Persistent Valuation Concerns

AWFIS Space Solutions Ltd., a small-cap player in India's co-working space sector, delivered a strong sequential profit recovery in Q3 FY26, with net profit surging 60.02% quarter-on-quarter to ₹15.97 crores. However, the year-on-year comparison tells a starkly different story, with profits plunging 58.70% from the exceptional ₹38.67 crores reported in Q3 FY25. Despite robust revenue momentum and margin expansion, the stock continues to trade under severe pressure, down 41.62% over the past year and hovering near its 52-week low of ₹377.60.

Read full news article

AWFIS Space Solutions Ltd Technical Momentum Shifts Amid Bearish Market Sentiment

AWFIS Space Solutions Ltd has experienced a notable shift in its technical momentum, with recent indicators signalling a transition from bearish to mildly bearish trends. Despite a modest day gain of 0.86%, the stock’s broader technical landscape remains complex, reflecting mixed signals from key momentum and trend-following indicators such as MACD, RSI, and moving averages.

Read full news article

AWFIS Space Solutions Ltd Falls to 52-Week Low of Rs.377.6

AWFIS Space Solutions Ltd’s stock declined to a fresh 52-week low of Rs.377.6 today, marking a significant milestone in its ongoing downward trajectory. This new low comes amid a year of underwhelming returns and persistent challenges reflected in key financial metrics and market performance.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Mutual Funds

None

Held by 18 Schemes (35.98%)

Held by 45 FIIs (27.34%)

Amit Ramani (16.81%)

Hdfc Small Cap Fund (9.67%)

9.57%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.07% vs 9.61% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 35.63% vs 60.02% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 27.53% vs 38.97% in Sep 2024

Growth in half year ended Sep 2025 is -37.41% vs 427.75% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 24.83% vs 40.77% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -15.94% vs 399.05% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 42.26% vs 55.67% in Mar 2024

YoY Growth in year ended Mar 2025 is 486.28% vs 62.33% in Mar 2024