Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.05 times

Poor long term growth as Net Sales has grown by an annual rate of 12.21% and Operating profit at 18.03% over the last 5 years

The company has declared Positive results for the last 6 consecutive quarters

With ROCE of 13.6, it has a Expensive valuation with a 6.6 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.67% of the company

Stock DNA

Computers - Software & Consulting

INR 5,353 Cr (Small Cap)

60.00

28

0.00%

0.26

13.32%

7.67

Total Returns (Price + Dividend)

AXISCADES Tech. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

AXISCADES Tech. Sees Revision in Market Assessment Amid Mixed Financial Signals

AXISCADES Tech., a small-cap player in the Computers - Software & Consulting sector, has experienced a revision in its market evaluation reflecting a nuanced view of its recent financial and technical performance. This adjustment comes amid a backdrop of strong profit growth but tempered by concerns over long-term sales expansion and valuation metrics relative to peers.

Read More

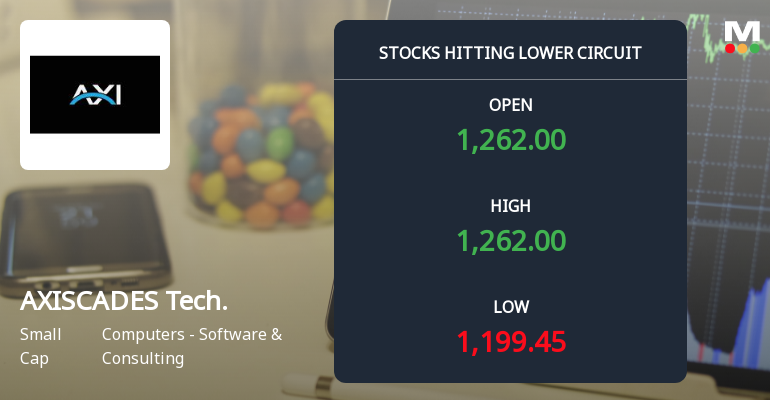

AXISCADES Technologies Hits Lower Circuit Amid Heavy Selling Pressure

Shares of AXISCADES Technologies Ltd plunged to their lower circuit limit on 17 Dec 2025, reflecting intense selling pressure and a sharp intraday decline. The stock closed at ₹1,198.10, marking a 5.0% drop from the previous close, as investors reacted to sustained negative momentum and unfilled supply in the market.

Read More

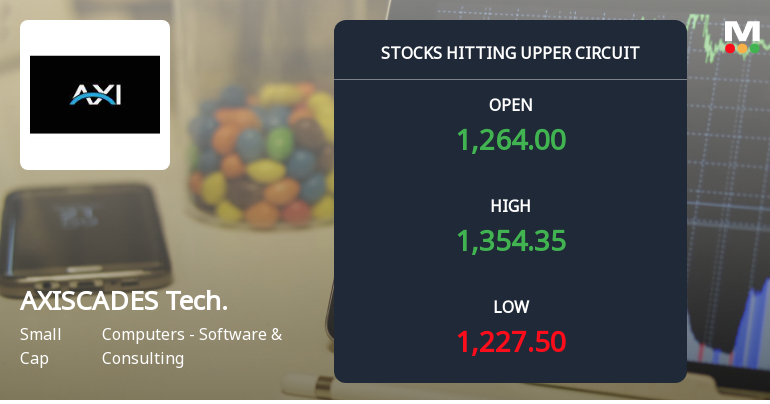

AXISCADES Technologies Hits Upper Circuit Amid Strong Buying Pressure

AXISCADES Technologies Ltd witnessed a robust trading session on 9 Dec 2025, hitting its upper circuit limit with a maximum daily gain of 4.95%, reflecting intense buying interest and heightened market activity in the Computers - Software & Consulting sector.

Read More Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Dec-2025 | Source : BSEIntimation of schedule of Analysts/Institutional Investors Meeting

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

25-Nov-2025 | Source : BSEIntimation of schedule of Analysts / Institutional Investors Meeting under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

20-Nov-2025 | Source : BSEIntimation of Allotment of ESOP

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

15.78

Held by 2 Schemes (0.28%)

Held by 38 FIIs (2.18%)

Jupiter Capital Private Limited (58.08%)

Sanjay Katkar (1.54%)

29.27%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 22.71% vs -9.05% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 10.94% vs -32.54% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 11.17% vs 4.53% in Sep 2024

Growth in half year ended Sep 2025 is 49.03% vs 76.18% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 9.07% vs 17.40% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 83.32% vs 213.84% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.92% vs 16.25% in Mar 2024

YoY Growth in year ended Mar 2025 is 128.41% vs 727.34% in Mar 2024