Compare BCPL Railway with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -5.16% CAGR growth in Operating Profits over the last 5 years

- The company has been able to generate a Return on Equity (avg) of 8.47% signifying low profitability per unit of shareholders funds

Flat results in Dec 25

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Latest dividend: 0.7 per share ex-dividend date: Sep-19-2024

Risk Adjusted Returns v/s

Returns Beta

News

BCPL Railway Infrastructure Q2 FY26: Profit Surge Masks Mounting Execution Challenges

BCPL Railway Infrastructure Ltd., a Kolkata-based railway construction specialist with a market capitalisation of ₹118.00 crores, delivered a consolidated net profit of ₹3.22 crores in Q2 FY26 (Jul-Sep'25), marking a remarkable 161.79% sequential surge from the previous quarter's ₹1.23 crores. However, this impressive quarterly rebound masks deeper operational concerns, as the stock continues its bearish trajectory, trading at ₹70.47—down 41.23% from its 52-week high of ₹119.91 and underperforming the broader market by 25.51% over the past year.

Read full news articleAre BCPL Railway Infrastructure Ltd latest results good or bad?

BCPL Railway Infrastructure Ltd's latest financial results for Q2 FY26 present a complex picture of performance. The company reported consolidated net sales of ₹58.26 crores, reflecting a sequential decline of 12.77% from ₹66.79 crores in Q1 FY26. However, on a year-over-year basis, sales showed significant growth of 117.88% compared to ₹26.74 crores in Q2 FY25, indicating an expanding project pipeline and improved execution capabilities. Consolidated net profit for the quarter surged to ₹3.22 crores, a notable increase of 161.79% from ₹1.23 crores in Q1 FY26, marking the highest quarterly profit in the company's recent history. The profit after tax margin also expanded to 5.32%, up from 0.79% in the previous quarter, driven by improved operating leverage and a lower tax incidence. Operating margins, excluding other income, improved to 8.26% from 2.38% in Q1 FY26, although they remain below the 11.66% ach...

Read full news article

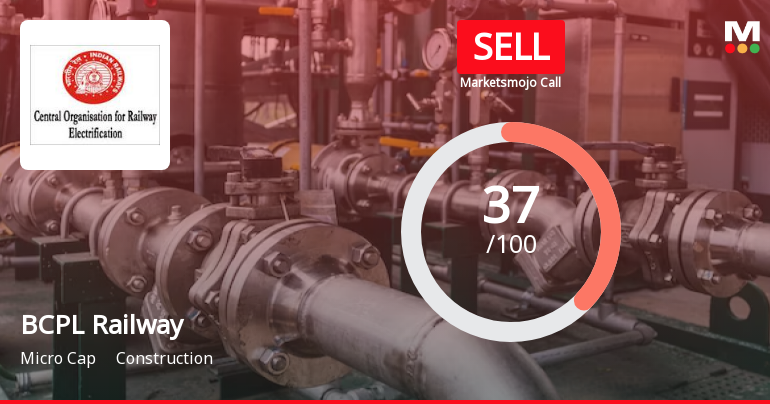

BCPL Railway Infrastructure Ltd is Rated Sell

BCPL Railway Infrastructure Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 15 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 29 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

24-Jan-2026 | Source : BSEPlease find attached the newspaper publications in English - Financial Express and Bengali- Arthik Lipi relating to the notice of the Board meeting to be held on (Thursday) 29.01.2026 to consider the un-audited financial results for the quarter and nine months ended on 31.12.2025.

Board Meeting Intimation for Notice Of The Board Meeting To Be Held On 29.01.2026

22-Jan-2026 | Source : BSEBCPL Railway Infrastructure Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 29/01/2026 inter alia to consider and approve In pursuance of Regulations 29 and 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that the meeting of the Board of Directors of the Company will be held on January 29 2025 (Thursday) at 3.30pm through video conferencing to consider and approve the following:- 1. Un-Audited Financial Statements standalone and consolidated for the quarter and nine months ended December 31 2025. 2. General business discussions.

Update on board meeting

22-Jan-2026 | Source : BSEBCPL Railway Infrastructure Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 29/01/2026 inter alia to consider and approve In pursuance of Regulations 29 and 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that the meeting of the Board of Directors of the Company will be held on January 29 2026 (Thursday) at 3.30pm through video conferencing to consider and approve the following:- 1. Un-Audited Financial Statements standalone and consolidated for the quarter and nine months ended December 31 2025. 2. General business discussions.

Corporate Actions

No Upcoming Board Meetings

BCPL Railway Infrastructure Ltd has declared 7% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.0049

Held by 0 Schemes

Held by 0 FIIs

Kanhai Singh (15.71%)

None

24.85%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -53.31% vs -12.77% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -63.98% vs 161.79% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 177.89% vs 5.14% in Sep 2024

Growth in half year ended Sep 2025 is 14.99% vs 1.04% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 83.12% vs 33.95% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 16.15% vs -0.41% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 82.94% vs -28.39% in Mar 2024

YoY Growth in year ended Mar 2025 is 22.06% vs -32.42% in Mar 2024