Compare Bharat Dynamics with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Poor long term growth as Net Sales has grown by an annual rate of 12.15% and Operating profit at 10.20% over the last 5 years

With a growth in Net Sales of 110.55%, the company declared Very Positive results in Sep 25

With ROE of 15.5, it has a Very Expensive valuation with a 13.3 Price to Book Value

Majority shareholders : Promoters

Consistent Returns over the last 3 years

Stock DNA

Aerospace & Defense

INR 57,074 Cr (Mid Cap)

86.00

48

0.30%

-0.99

15.51%

13.65

Total Returns (Price + Dividend)

Latest dividend: 0.65 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

Bharat Dynamics Ltd Sees Sharp Open Interest Surge Amid Mixed Market Signals

Bharat Dynamics Ltd (BDL), a key player in the Aerospace & Defence sector, witnessed a notable 10.9% surge in open interest (OI) in its derivatives segment on 29 Jan 2026, signalling heightened market activity and shifting investor positioning. Despite this, the stock price declined by 2.61% amid mixed volume patterns and a sector-wide downturn, raising questions about the underlying directional bets and market sentiment.

Read full news article

Bharat Dynamics Ltd Sees Sharp Open Interest Surge Amid Mixed Market Signals

Bharat Dynamics Ltd (BDL), a key player in the Aerospace & Defence sector, witnessed a notable 11.08% surge in open interest (OI) in its derivatives segment on 27 Jan 2026, signalling heightened market activity and shifting investor positioning. Despite the stock’s recent underperformance relative to its sector, the increase in OI alongside rising volumes suggests evolving directional bets and a complex interplay of bullish and cautious sentiment among traders.

Read full news article

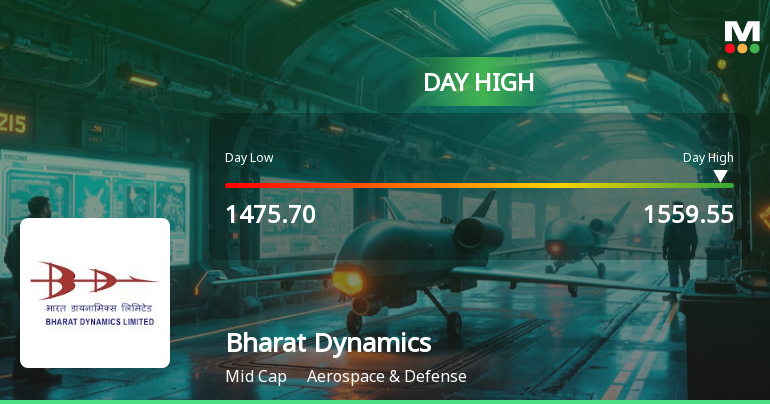

Bharat Dynamics Ltd Hits Intraday High with 5.28% Surge on 28 Jan 2026

Bharat Dynamics Ltd recorded a robust intraday performance on 28 Jan 2026, surging 5.28% to touch a day’s high of Rs 1,546.4, outperforming its sector and broader market indices amid positive trading momentum.

Read full news article Announcements

Bharat Dynamics Limited - Other General Purpose

05-Dec-2019 | Source : NSEBharat Dynamics Limited has submitted to the Exchange a copy of disclosure of Related Party Transactions for the half year ended September 30, 2019 pursuant to Regulation 23(9) of SEBI (LODR) Regulations, 2015.á

Bharat Dynamics Limited - Updates

03-Dec-2019 | Source : NSEBharat Dynamics Limited has informed the Exchange regarding 'Extension of tenure of Shri S. Piramanayagam Director (Finance)'.

Bharat Dynamics Limited - Appointment

13-Nov-2019 | Source : NSEBharat Dynamics Limited has informed the Exchange regarding Appointment of Mr G.Natesan & Co., Chartered Accountants as Statutory Auditors (for the financial year 2019-20) of the company w.e.f. November 12, 2019.

Corporate Actions

31 Jan 2026

Bharat Dynamics Ltd has declared 13% dividend, ex-date: 19 Sep 25

Bharat Dynamics Ltd has announced 5:10 stock split, ex-date: 24 May 24

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 29 Schemes (5.52%)

Held by 95 FIIs (2.3%)

President Of India (74.93%)

Motilal Oswal Large And Midcap Fund (1.72%)

10.49%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 114.22% vs -12.22% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 76.19% vs -16.70% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 90.56% vs -20.14% in Sep 2024

Growth in half year ended Sep 2025 is 80.52% vs -31.32% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1.37% vs -10.18% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -14.53% vs 62.45% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 41.37% vs -4.80% in Mar 2024

YoY Growth in year ended Mar 2025 is -10.29% vs 73.98% in Mar 2024