Compare BigBear.ai Holdings, Inc. with Similar Stocks

Stock DNA

Software Products

USD 2,493 Million (Small Cap)

NA (Loss Making)

NA

0.00%

-0.79

-12.92%

4.09

Total Returns (Price + Dividend)

BigBear.ai Holdings, Inc. for the last several years.

Risk Adjusted Returns v/s

News

BigBear.ai Stock Soars 16.11%, Hits Intraday High of $6.28

BigBear.ai Holdings, Inc. has seen a notable rise in its stock price, reaching an intraday high on November 24, 2025. Over the past year, the company has significantly outperformed the S&P 500, despite recent challenges, including a decline in one-month performance and negative financial metrics.

Read full news article

BigBear.ai Stock Soars to Day High with Strong Intraday Performance

BigBear.ai Holdings, Inc. has experienced significant stock price growth, with a notable year-over-year increase of 239.77%. Despite recent fluctuations, including a decline over the past month, the company has achieved a remarkable 510.89% increase over the last three years, with a market capitalization of USD 1,854 million.

Read full news article

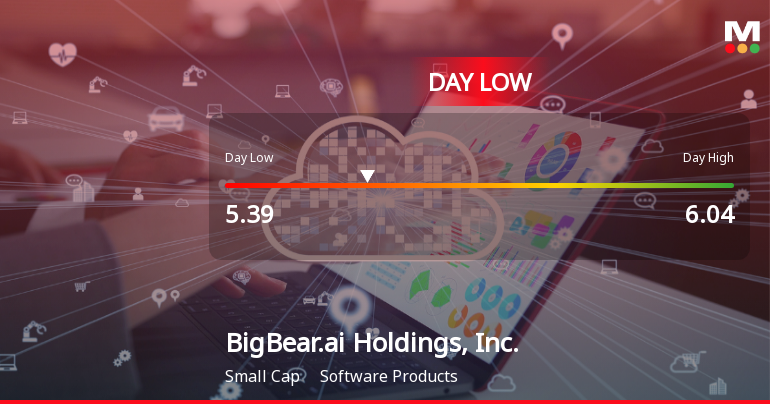

BigBear.ai Hits Day Low of $5.38 Amid Price Pressure

BigBear.ai Holdings, Inc. faced a notable decline in its stock price, reaching an intraday low amid a challenging trading environment. Despite recent struggles, the company has shown impressive growth over the past year. Financial metrics reveal pressures, including decreased net sales and rising raw material costs.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 22 Schemes (12.02%)

Held by 67 Foreign Institutions (2.4%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -6.61% vs -20.55% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is -268.71% vs 42.59% in Mar 2025

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 1.93% vs 0.13% in Dec 2023

YoY Growth in year ended Dec 2024 is -317.96% vs 41.91% in Dec 2023