Compare Bloom Dekor with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -31.75% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

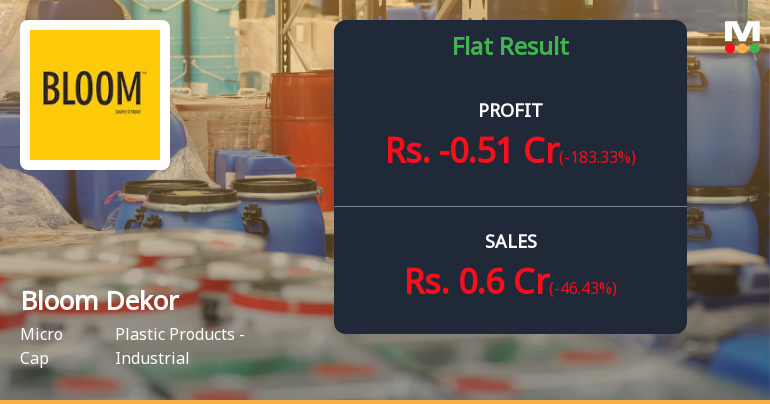

Flat results in Dec 25

Risky - Negative EBITDA

Stock DNA

Plastic Products - Industrial

INR 8 Cr (Micro Cap)

NA (Loss Making)

34

0.00%

-1.67

15.03%

-1.22

Total Returns (Price + Dividend)

Latest dividend: 0.6 per share ex-dividend date: Jul-30-2015

Risk Adjusted Returns v/s

Returns Beta

News

Are Bloom Dekor Ltd latest results good or bad?

Bloom Dekor Ltd's latest financial results for Q3 FY26 reflect significant operational challenges and a continuation of a troubling trend. The company reported net sales of ₹0.60 crores, which represents a sharp decline of 46.43% compared to the previous quarter and a year-on-year contraction of 28.57%. This revenue drop has been accompanied by a net loss of ₹0.51 crores, marking a substantial increase in losses when compared to both the previous quarter and the same quarter last year. The operating margin for the quarter was recorded at -98.33%, the worst performance in eight quarters, indicating severe margin compression and operational inefficiencies. Additionally, the company's book value per share is negative at ₹-9.60, highlighting a critical solvency issue with negative equity of ₹6.58 crores. This situation raises concerns about the company's long-term viability, especially given its debt burden of...

Read full news article

Bloom Dekor Q3 FY26: Deepening Losses Raise Viability Concerns

Bloom Dekor Ltd., an Ahmedabad-based manufacturer and exporter of high-pressure decorative laminates, reported a significant deterioration in its Q3 FY26 financial performance, posting a net loss of ₹0.51 crores compared to a loss of ₹0.32 crores in Q3 FY25. The micro-cap company, with a market capitalisation of just ₹8.00 crores, saw revenues plunge 46.43% quarter-on-quarter to ₹0.60 crores whilst operating margins collapsed to -98.33%, marking the worst quarterly performance in recent history. Following the results, the stock trades at ₹11.99, down marginally by 0.08% from the previous close.

Read full news articleAre Bloom Dekor Ltd latest results good or bad?

Bloom Dekor Ltd's latest financial results for the quarter ended September 2025 reveal significant operational challenges and ongoing financial distress. The company reported net sales of ₹1.12 crores, which represents a sharp decline of 45.63% from the previous quarter's ₹2.06 crores. This decline in revenue indicates severe demand challenges or operational disruptions that have hindered the company's ability to maintain momentum. Year-on-year, the revenue also showed a decrease of 15.79% from ₹1.33 crores in the same quarter last year. The operating performance remains deeply concerning, with an operating loss of ₹0.10 crores, leading to a negative operating margin of 8.93%. This marks a significant reversal from the previous quarter, where the company had briefly achieved a positive operating profit. The persistent negative margins highlight ongoing structural cost challenges and the company's inability...

Read full news article Announcements

Unaudited Financial Results For The Quarter Ended On December 31 2025

23-Jan-2026 | Source : BSEUnaudited Financial results for the Quarter ended on December 31 2025

Board Meeting Outcome for Outcome Of Board Meeting Held On Today I.E. On January 23 2026

23-Jan-2026 | Source : BSEOutcome of Board Meeting held on Today i.e on January 23 2026

Board Meeting Intimation for Meeting Scheduled To Be Held On January 23 2026

19-Jan-2026 | Source : BSEBloom Dekor Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 23/01/2026 inter alia to consider and approve and take on record the unaudited Financial Results of the Company for the quarter ended on December 31 2025 as per Regulation 33 of the Listing Regulation and any other items as may be decided by the Board of Directors. In this connection and in continuation of our intimation regarding Closure of Trading Window for the Insiders of the Company vide letter dated December 29 2025 the trading window for dealing in the securities of the Company is already closed for the Insiders of the Company since Thursday January 01 2026.

Corporate Actions

No Upcoming Board Meetings

Bloom Dekor Ltd has declared 6% dividend, ex-date: 30 Jul 15

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sunil Sitaram Gupta (31.96%)

Bimalkumar P Brahmbhatt (11.96%)

18.05%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -46.43% vs -45.63% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -183.33% vs -550.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 20.00% vs -23.63% in Sep 2024

Growth in half year ended Sep 2025 is 61.11% vs 23.40% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.31% vs -28.04% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 4.41% vs 17.07% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -21.12% vs -47.77% in Mar 2024

YoY Growth in year ended Mar 2025 is -21.18% vs -103.96% in Mar 2024