Compare Bodhtree Consul. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -41.16% CAGR growth in Net Sales over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -4.32

- The company has been able to generate a Return on Equity (avg) of 4.56% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Stock DNA

Computers - Software & Consulting

INR 56 Cr (Micro Cap)

121.00

25

0.00%

-0.60

2.02%

2.40

Total Returns (Price + Dividend)

Latest dividend: 0.6999999999999998 per share ex-dividend date: Sep-10-2018

Risk Adjusted Returns v/s

Returns Beta

News

Bodhtree Consulting Ltd is Rated Strong Sell

Bodhtree Consulting Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 06 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleAre Bodhtree Consulting Ltd latest results good or bad?

Bodhtree Consulting Ltd's latest financial results for the quarter ending December 2025 reveal a complex operational landscape. The company reported net sales of ₹2.32 crores, which reflects a significant sequential increase of 603.03% from the previous quarter. However, this figure starkly contrasts with a dramatic year-on-year decline of 89.63% from ₹22.37 crores in the same quarter last year, indicating severe revenue erosion over time. Despite the surge in revenue, Bodhtree Consulting experienced a net loss of ₹0.62 crores, which represents a substantial widening of losses compared to the previous quarter's loss of ₹0.06 crores. This indicates ongoing profitability challenges, as the company continues to struggle with operational inefficiencies and a misaligned cost structure. The operating margin for the quarter stood at -6.90%, showing a slight improvement from -21.21% in the prior quarter but still ...

Read full news article

Bodhtree Consulting Q3 FY26: Revenue Surge Masks Persistent Profitability Crisis

Bodhtree Consulting Ltd., a Hyderabad-based IT and IT-enabling services provider, has delivered a turbulent performance in the December 2025 quarter, with revenues surging 603.03% quarter-on-quarter to ₹2.32 crores whilst net losses deepened to ₹0.62 crores. The micro-cap software consulting firm, commanding a market capitalisation of just ₹57.00 crores, continues to grapple with operational challenges that have plagued its financial performance for over two years. The stock closed at ₹25.01 on February 2, 2026, down 3.84% from the previous session, reflecting investor concerns about the company's ability to return to sustained profitability despite intermittent revenue spikes.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Feb-2026 | Source : BSEEnclosed Newspaper Publication of Un-audited Financial Results for the Quarter and Nine Months ended December 31 2025.

Announcement under Regulation 30 (LODR)-Change in Management

03-Feb-2026 | Source : BSEMr. Nikshit Hemendra Shah has been appointed as the Chairman of the company w.e.f. February 02 2026.

Board Meeting Outcome for Outcome Of The Board Meeting Held On Monday February 02 2026.

02-Feb-2026 | Source : BSEOutcome for the Board Meeting held on Monday February 02 2026.

Corporate Actions

No Upcoming Board Meetings

Bodhtree Consulting Ltd has declared 7% dividend, ex-date: 10 Sep 18

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Prem Anandh (54.88%)

Micro Sparks Venture Llp (1.2%)

20.14%

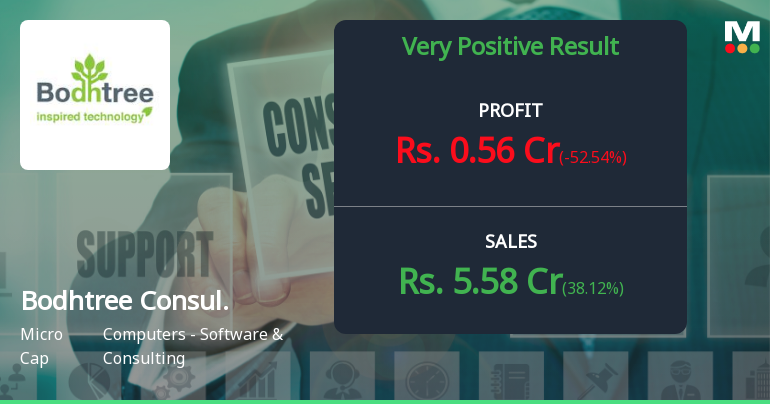

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 38.12% vs 74.14% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -52.54% vs 290.32% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 294.96% vs -33.49% in Sep 2024

Growth in half year ended Sep 2025 is 145.34% vs -65.98% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 103.87% vs 23.13% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 400.00% vs 72.96% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -63.35% vs -57.91% in Mar 2024

YoY Growth in year ended Mar 2025 is 48.37% vs 90.63% in Mar 2024