Compare Bombay Cycle with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -25.62% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.65

- The company has been able to generate a Return on Equity (avg) of 9.34% signifying low profitability per unit of shareholders funds

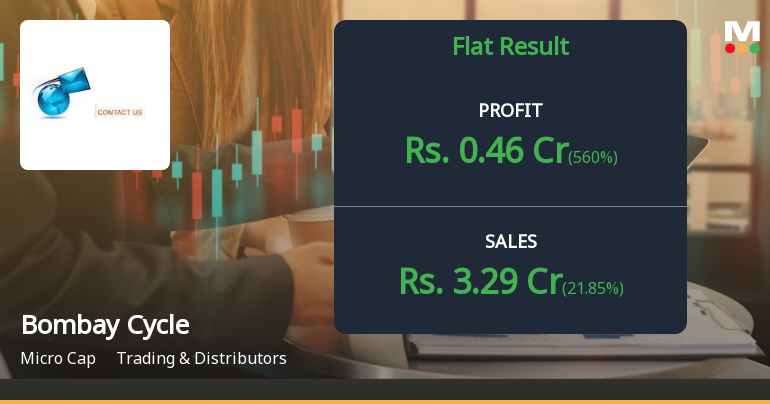

Flat results in Dec 25

With ROE of 4.9, it has a Very Expensive valuation with a 2.5 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Trading & Distributors

INR 69 Cr (Micro Cap)

51.00

25

0.00%

-0.36

4.86%

2.46

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Jul-26-2024

Risk Adjusted Returns v/s

Returns Beta

News

Are Bombay Cycle & Motor Agency Ltd latest results good or bad?

Bombay Cycle & Motor Agency Ltd has reported its latest financial results, which reveal a complex picture of operational performance. In Q2 FY26, the company experienced a consolidated net profit of -₹0.10 crores, reflecting a significant decline compared to the previous quarter and the same quarter last year. Despite this, the company achieved a modest revenue growth of 6.72% quarter-on-quarter, with net sales reaching ₹2.70 crores. The operating margin, however, has faced considerable pressure, dropping to 4.81% from 22.92% in Q2 FY25, indicating severe operational challenges. The company's profitability metrics have raised concerns regarding its business model's sustainability, particularly in its automotive and hospitality divisions. In the subsequent quarter ending December 2025, preliminary data indicates a recovery in performance, with net sales showing a quarter-on-quarter growth of 21.85% and a...

Read full news article

Bombay Cycle & Motor Agency Q2 FY26: Profitability Crisis Deepens as Losses Mount

Bombay Cycle & Motor Agency Ltd., the Mumbai-based automotive sales and hospitality services company, reported a consolidated net loss of ₹0.10 crores for Q2 FY26, marking a sharp reversal from the ₹1.62 crores profit recorded in Q1 FY26. The ₹69.00 crores market capitalisation company has witnessed its profitability evaporate over consecutive quarters, with the stock trading at ₹1,725.00 as of February 06, 2026, down 22.99% over the past year.

Read full news article

Bombay Cycle & Motor Agency Ltd is Rated Strong Sell

Bombay Cycle & Motor Agency Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 04 Nov 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 30 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Board Meeting Outcome for Board Meeting Outcome Dated February 06 2026

06-Feb-2026 | Source : BSEThis is to inform you that the Un-audited (Reviewed) Standalone and Consolidated Financial Results for the Quarter and Nine Months ended on December 31 2025 were approved and taken on record at the meeting of the Board of Directors of the Company held today i.e. February 06 2026. A copy of the same along with Limited Review Report on the Un-audited (Reviewed) Standalone and Consolidated Financial Results for the Quarter and Nine Months ended on December 31 2025 issued by M/s. L M R A & Associates Chartered Accountants (Statutory Auditors of the Company) are enclosed for your information and record.

Standalone And Consolidated Un-Audited Financial Results For The Quarter And Nine Months Ended December 31 2025

06-Feb-2026 | Source : BSEPlease find enclosed herewith Standalone and Consolidated Un-Audited Financial Results for the quarter and nine months ended December 31 2025.

Board Meeting Intimation for Considering Approving And Taking On Record Amongst Other Business The Un-Audited Financial Results And Segment-Wise Financial Result Of The Company For The Quarter And Nine Months Ended On December 31 2025.

30-Jan-2026 | Source : BSEBombay Cycle & Motor Agency Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve and taking on record amongst other business the Un-Audited financial results of the Company for the quarter and nine months ended on December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Bombay Cycle & Motor Agency Ltd has declared 50% dividend, ex-date: 26 Jul 24

No Splits history available

Bombay Cycle & Motor Agency Ltd has announced 1:1 bonus issue, ex-date: 13 Aug 19

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Walchand Kamdhenu Commercials Private Limited (23.76%)

Rajan Malhotra (2.87%)

22.3%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 21.85% vs 6.72% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 560.00% vs -106.17% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.03% vs 22.41% in Sep 2024

Growth in half year ended Sep 2025 is -29.95% vs 36.48% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.41% vs 16.64% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -10.00% vs -10.20% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 12.72% vs 6.60% in Mar 2024

YoY Growth in year ended Mar 2025 is -198.72% vs 74.86% in Mar 2024