Compare Borosil with Similar Stocks

Stock DNA

Diversified consumer products

INR 2,906 Cr (Small Cap)

35.00

52

0.00%

0.05

10.20%

3.46

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Aug-17-2021

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Borosil Ltd?

The next results date for Borosil Ltd is scheduled for 05 February 2026....

Read full news article

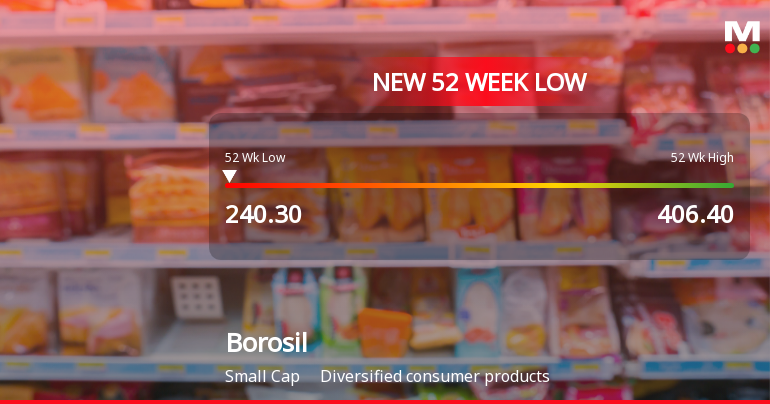

Borosil Ltd Stock Hits 52-Week Low at Rs.240.05 Amid Market Pressure

Borosil Ltd, a key player in the diversified consumer products sector, recorded a fresh 52-week low of Rs.240.05 today, marking a significant decline in its stock price amid broader market pressures and sectoral underperformance.

Read full news article

Borosil Ltd Stock Falls to 52-Week Low of Rs.240.3 Amidst Continued Downtrend

Borosil Ltd’s shares declined to a fresh 52-week low of Rs.240.3 on 29 Jan 2026, marking a continuation of the stock’s downward trajectory over recent sessions. The stock has now recorded a four-day consecutive fall, shedding nearly 5% in that period, reflecting ongoing pressures within the diversified consumer products sector.

Read full news article Announcements

Board Meeting Intimation for Board Meeting Scheduled To Be Held On February 5 2026

29-Jan-2026 | Source : BSEBorosil Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve the Unaudited Financial Results (Standalone & Consolidated) for the quarter and nine months ended December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Jan-2026 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended December 31 2025.

Closure of Trading Window

26-Dec-2025 | Source : BSEIntimation of Closure of Trading Window.

Corporate Actions

05 Feb 2026

Borosil Ltd has declared 100% dividend, ex-date: 17 Aug 21

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (3.47%)

Held by 28 FIIs (0.35%)

Kiran Kheruka (23.95%)

Dsp Small Cap Fund (3.43%)

21.94%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 46.27% vs -13.88% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 30.44% vs 56.28% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 14.73% vs 21.55% in Sep 2024

Growth in half year ended Sep 2025 is 45.31% vs 17.54% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 17.20% vs 2.86% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 3.78% vs 0.71% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.79% vs 27.91% in Mar 2024

YoY Growth in year ended Mar 2025 is 12.69% vs 26.99% in Mar 2024