Compare Brijlaxmi Leas. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 9.94%

The company has declared Positive results for the last 3 consecutive quarters

With ROE of 59.3, it has a Very Attractive valuation with a 1.4 Price to Book Value

Majority shareholders : Non Institution

Consistent Returns over the last 3 years

Stock DNA

Non Banking Financial Company (NBFC)

INR 8 Cr (Micro Cap)

2.00

22

0.00%

2.21

59.29%

1.32

Total Returns (Price + Dividend)

Brijlaxmi Leas. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Brijlaxmi Leasing & Finance Ltd is Rated Hold

Brijlaxmi Leasing & Finance Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 09 Dec 2025. While the rating change occurred on that date, the analysis and financial metrics discussed here reflect the company’s current position as of 26 December 2025, providing investors with the most up-to-date view of the stock’s fundamentals, returns, and technical outlook.

Read full news article

Brijlaxmi Leasing & Finance Hits New 52-Week High at Rs.17.69

Brijlaxmi Leasing & Finance, a key player in the Non Banking Financial Company (NBFC) sector, reached a fresh 52-week high of Rs.17.69 today, marking a significant milestone in its stock performance. This new peak reflects sustained momentum driven by a series of gains over recent sessions and notable outperformance relative to its sector peers.

Read full news article

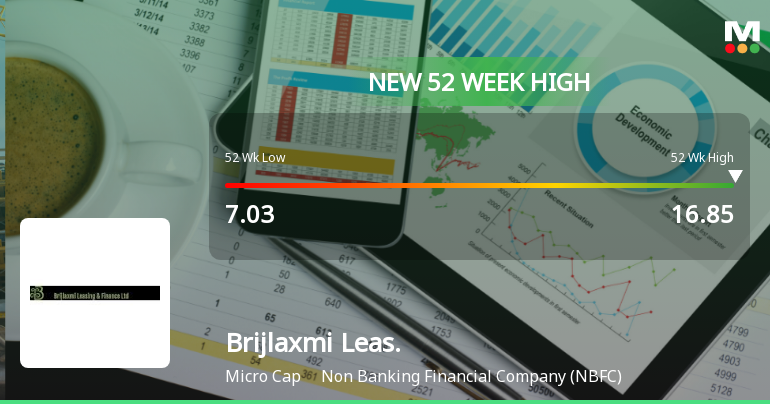

Brijlaxmi Leasing & Finance Hits New 52-Week High at Rs.16.85

Brijlaxmi Leasing & Finance, a key player in the Non Banking Financial Company (NBFC) sector, reached a significant milestone today by touching a new 52-week high of Rs.16.85. This achievement marks a notable phase in the stock’s performance, reflecting sustained momentum over recent sessions.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Jan-2026 | Source : BSEPlease find the attached Compliance Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Shareholder Meeting / Postal Ballot-Scrutinizers Report

05-Jan-2026 | Source : BSEWe herewith submit Voting Result of Extra Ordinary General Meeting of the company held on Friday 02nd January 2026 under Regulations 44(3) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 along with Scrutinizers Report.

Shareholder Meeting / Postal Ballot-Outcome of EGM

02-Jan-2026 | Source : BSEProceeding of Extra Ordinary General Meeting held on 02nd January 2026 at 12:00 pm through VC/OAVM.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Brijlaxmi Leasing & Finance Ltd has announced 10:1 stock split, ex-date: 15 Nov 18

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Jaykishor Chaturvedi (7.8%)

Satya Securities Limited (3.49%)

64.83%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 35.71% vs -44.55% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 152.78% vs -289.47% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 15.24% vs -36.75% in Sep 2024

Growth in half year ended Sep 2025 is 134.07% vs -364.71% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -39.77% vs 82.39% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -351.28% vs 1,400.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 99.37% vs -17.19% in Mar 2024

YoY Growth in year ended Mar 2025 is 107.89% vs 1,050.00% in Mar 2024