Compare C J Gelatine with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 5.01 times)- the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 0% of over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

- The company has reported losses. Due to this company has reported negative ROE

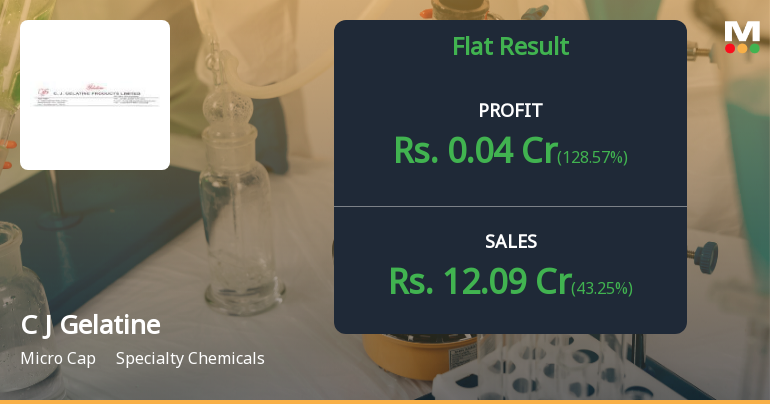

Flat results in Dec 25

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Specialty Chemicals

INR 8 Cr (Micro Cap)

141.00

39

0.00%

5.01

2.87%

1.93

Total Returns (Price + Dividend)

C J Gelatine for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

C J Gelatine Products Ltd Valuation Shifts Amid Mixed Market Performance

C J Gelatine Products Ltd has experienced a notable shift in its valuation parameters, moving from an attractive to a fair rating, driven primarily by changes in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios. This article analyses these valuation metrics in the context of historical trends, peer comparisons within the specialty chemicals sector, and broader market performance, providing investors with a comprehensive view of the stock’s price attractiveness.

Read full news articleAre C J Gelatine Products Ltd latest results good or bad?

C J Gelatine Products Ltd's latest financial results reflect a complex operational landscape. In the second quarter of FY26, the company reported a net profit of ₹0.04 crores, marking a return to profitability after a loss in the previous quarter. This represents a significant sequential improvement from a net loss of ₹0.14 crores in Q1 FY26. However, the net profit margin remains extremely thin at just 0.33%, raising concerns about the company's ability to sustain profitability in the long term. The company's revenue for Q2 FY26 showed a year-on-year growth of 20.18%, although it experienced a quarter-on-quarter decline of 15.63% in the subsequent quarter ending December 2025. This indicates that while there was some positive momentum in terms of sales, it was not consistent, suggesting potential volatility in demand or operational challenges. Operating margins improved to 4.30% in Q2 FY26 from 3.91% in ...

Read full news article

C J Gelatine Products Q2 FY26: Modest Recovery Masks Deeper Structural Challenges

C J Gelatine Products Ltd., a micro-cap speciality chemicals manufacturer with a market capitalisation of ₹8.00 crores, reported a modest return to profitability in Q2 FY26 with net profit of ₹0.04 crores, reversing a loss of ₹0.14 crores in Q1 FY26. However, the quarter-on-quarter improvement masks significant structural challenges facing the Mumbai-based gelatine producer, including razor-thin margins, elevated debt levels, and persistent underperformance against both peers and broader market indices.

Read full news article Announcements

Unaudited Integrated Financial Results For The Period Ended December 31 2025.

07-Feb-2026 | Source : BSEPlease find attached herewith the integrated unaudited standalone financial results of the Company for the Quarter and Nine Months ended December 31 2025 along with Limited Review Report issued by the Statutory Auditors of the Company.

Board Meeting Outcome for Meeting Held Today I.E. Saturday February 7 2026

07-Feb-2026 | Source : BSEThe Board of Directors of the Company at their Meeting held on today i.e. Saturday February 7 2026 have inter-alia considered and approved the Unaudited Financial Results / Statements of the Company for the Quarter and Nine Months ended December 31 2025 along-with Limited Review Report. The aforesaid Board Meeting was commenced at 1:30 p.m. (IST) and concluded at 4:00 p.m. (IST).

Board Meeting Intimation for Meeting To Be Held On Saturday February 7 2026 At 1:30 P.M. (IST).

31-Jan-2026 | Source : BSECJ Gelatine Products Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 07/02/2026 inter alia to consider and approve 1. unaudited financial results of the Company for the quarter and nine months ended December 31 2025 along with the Limited Review Report; 2. Any other matter with the permission of Chairman. Please find attached the detailed notice of Board Meeting.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Jaspal Singh (57.49%)

Krishan Kumar Amla (4.01%)

35.68%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -15.63% vs 43.25% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 175.00% vs 128.57% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 8.11% vs -5.67% in Sep 2024

Growth in half year ended Sep 2025 is 50.00% vs 86.11% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 2.71% vs 0.88% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 133.33% vs 98.27% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.98% vs 11.11% in Mar 2024

YoY Growth in year ended Mar 2025 is 104.10% vs -947.83% in Mar 2024