Compare Canara Robeco with Similar Stocks

Stock DNA

Capital Markets

INR 4,652 Cr (Small Cap)

24.00

21

0.64%

0.03

28.09%

6.84

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Dec-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

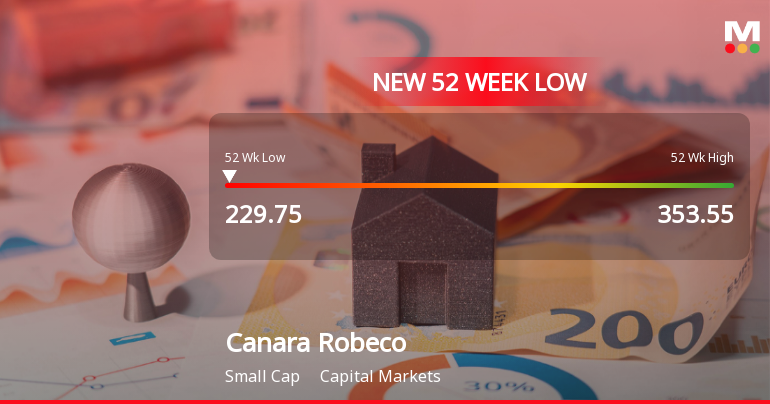

Canara Robeco Asset Management Company Ltd Falls to 52-Week Low of Rs.229.75

Shares of Canara Robeco Asset Management Company Ltd have declined to a fresh 52-week low of Rs.229.75, marking a significant downturn amid a broader market environment where the Sensex has shown modest gains. The stock’s recent performance reflects a series of declines over the past ten trading sessions, culminating in a cumulative loss of 12.63% during this period.

Read full news article

Canara Robeco Asset Management Stock Hits All-Time Low Amid Prolonged Downtrend

Shares of Canara Robeco Asset Management Company Ltd have fallen to a new all-time low of Rs. 230.75, marking a significant downturn for the capital markets firm as it continues a sustained period of negative returns and underperformance relative to broader market indices.

Read full news article

Canara Robeco Asset Management Company Ltd Falls to 52-Week Low of Rs.233.5

Shares of Canara Robeco Asset Management Company Ltd have declined to a fresh 52-week low of Rs.233.5, marking a significant price level for the capital markets firm amid a sustained downward trend over the past nine trading sessions.

Read full news article Announcements

Transcript Of Earnings Call -Q3 & 9M-FY2026 - Financial Results

29-Jan-2026 | Source : BSEPlease find enclosed the transcript of the Earnings call held on Tuesday January 27 2026 for the financial results for Quarter and nine months ended December 31 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

27-Jan-2026 | Source : BSEPlease find enclosed an audio recording of earnings call for the financial results for the quarter and nine months ended December 31 2025.

Announcement under Regulation 30 (LODR)-Investor Presentation

24-Jan-2026 | Source : BSEPlease find enclosed the revised Investor presentation with certain additional notes to bring more clarity to the investor.

Corporate Actions

No Upcoming Board Meetings

Canara Robeco Asset Management Company Ltd has declared 15% dividend, ex-date: 22 Dec 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 14 Schemes (11.5%)

Held by 14 FIIs (1.38%)

Canara Bank (38.0%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (2.49%)

9.01%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 12.70% vs -11.08% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 8.29% vs -20.12% in Sep 2025