Compare Cerebra Integr. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -1.10

- The company has been able to generate a Return on Equity (avg) of 2.50% signifying low profitability per unit of shareholders funds

The company has declared Negative results for the last 4 consecutive quarters

Risky - Negative EBITDA

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

IT - Hardware

INR 68 Cr (Micro Cap)

NA (Loss Making)

29

0.00%

0.29

-17.18%

0.51

Total Returns (Price + Dividend)

Cerebra Integr. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

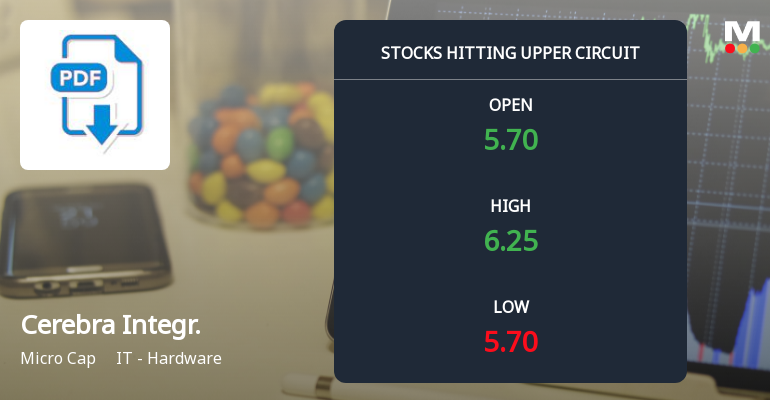

Cerebra Integrated Technologies Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Shares of Cerebra Integrated Technologies Ltd surged to hit the upper circuit limit on 1 Feb 2026, reflecting robust buying interest and a maximum permissible daily gain of 5%. This sharp price movement comes despite the company’s current Strong Sell mojo grade, underscoring a complex market dynamic in the IT - Hardware micro-cap segment.

Read full news article

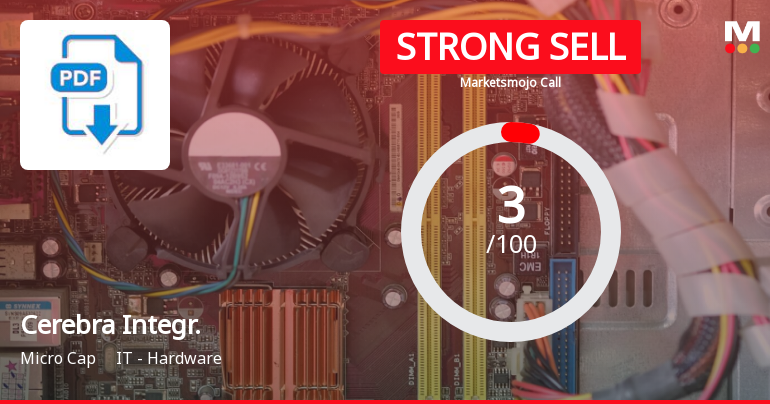

Cerebra Integrated Technologies Ltd is Rated Strong Sell

Cerebra Integrated Technologies Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 20 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and overall outlook.

Read full news article

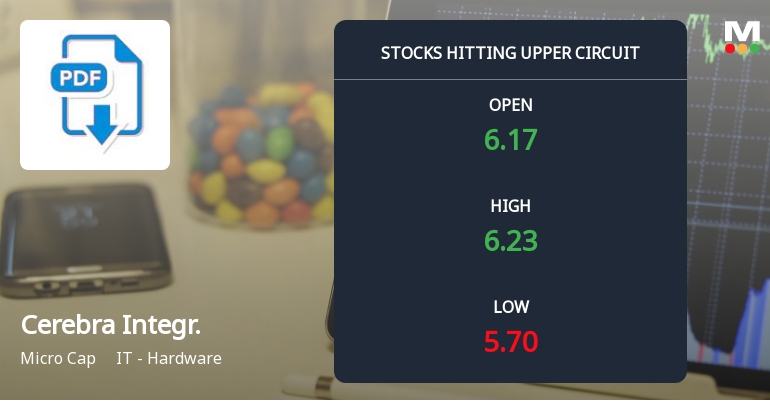

Cerebra Integrated Technologies Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Shares of Cerebra Integrated Technologies Ltd surged to hit the upper circuit limit on 30 Jan 2026, propelled by robust buying interest and a notable 4.84% gain on the day. This micro-cap IT hardware stock outperformed its sector and the broader market, reflecting heightened investor enthusiasm despite a recent downgrade in its mojo grade.

Read full news article Announcements

Intimation Under Regulation 30 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

23-Jan-2026 | Source : BSEPursuant to Regulation 30 read with Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 in continuation to the intimation dated 15th July 2025 this is to inform you that the Company has received e-auction sale notice under Section 13(4) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act 2002 (SARFAESI Act) from Canara Bank a secured lender of the Company on 23rd January 2026.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st December 2025

Closure of Trading Window

26-Dec-2025 | Source : BSEThe Trading Window for dealing in securities of the Company shall remain closed from Thursday 1st January 2025 till the expiry of 48 hours after the declaration of the unaudited Financial Results of the Company for the 3rd quarter. During the aforesaid closed Trading Window period the Employees Directors Key Managerial Personnel Promoters Designated Persons and their immediate relatives or any other insider shall not trade in Companys Shares/Securities. The date of the Board Meeting for declaration of the financial results of the Company for the 3rd quarter will be intimated in due course.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

V Ranganathan (0.66%)

Dhanlaxmi Jaswantrai Mehta (4.37%)

75.75%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 23.46% vs -28.97% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 31.56% vs -82.64% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -82.11% vs -9.80% in Sep 2024

Growth in half year ended Sep 2025 is 24.00% vs -27.55% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -9.98% vs -49.56% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 27.16% vs -1,547.47% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -31.47% vs -39.70% in Mar 2024

YoY Growth in year ended Mar 2025 is 2.21% vs -2,017.86% in Mar 2024