Dashboard

Poor long term growth as Operating profit has grown by an annual rate -6.47% of over the last 5 years

With a fall in Net Sales of -16.36%, the company declared Very Negative results in Sep 25

With ROCE of 1.8, it has a Very Expensive valuation with a 1.5 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.25% of the company

Underperformed the market in the last 1 year

Stock DNA

Commodity Chemicals

INR 647 Cr (Micro Cap)

195.00

41

0.27%

0.29

0.82%

1.67

Total Returns (Price + Dividend)

Latest dividend: 1.2 per share ex-dividend date: Sep-04-2025

Risk Adjusted Returns v/s

Returns Beta

News

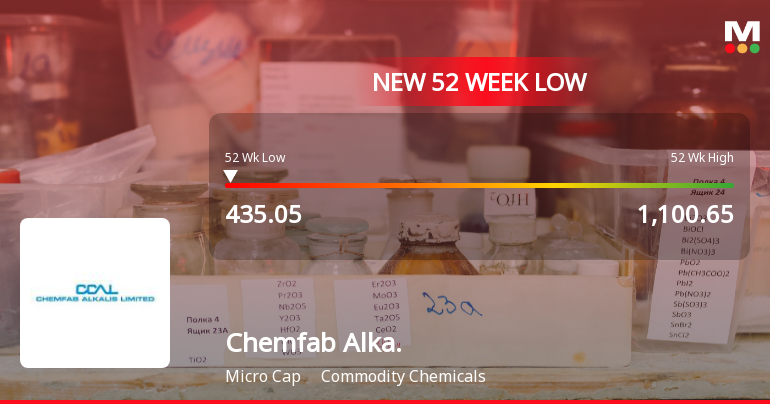

Chemfab Alkalis Stock Falls to 52-Week Low of Rs.426.7 Amidst Market Pressure

Chemfab Alkalis has reached a new 52-week low, with its stock price touching Rs.426.7 today. This marks a significant decline for the commodity chemicals company, reflecting ongoing pressures within its sector and broader market dynamics.

Read More

Chemfab Alkalis Stock Falls to 52-Week Low Amidst Prolonged Downtrend

Chemfab Alkalis has reached a new 52-week low, closing near Rs 435.05, marking a significant milestone in its ongoing price decline. The stock’s recent performance reflects a challenging period for the company within the commodity chemicals sector, as it trades well below key moving averages and continues to lag behind broader market indices.

Read More

Chemfab Alkalis Stock Falls to 52-Week Low of Rs.435.05 Amidst Market Underperformance

Chemfab Alkalis has reached a new 52-week low of Rs.435.05, marking a significant decline in its stock price amid a broader market environment where the Sensex continues to show strength. The stock’s recent performance contrasts sharply with the overall positive trend in the commodity chemicals sector and the wider market indices.

Read More Announcements

Reg(30)- Change In Name Of The Wholly Owned Subsidiary Of The Company

03-Dec-2025 | Source : BSEIntimation of change in name of the Wholly Owned Subsidiary - CHEMFAB ALKALIS KARAIKAL LIMITED to CHEMFAB KARAIIKAL LIMITED w.e.f. 3rd December 2025.

Announcement under Regulation 30 (LODR)-Acquisition

14-Nov-2025 | Source : BSEIncorporation of Wholly Owned Subsidiary

Announcement under Regulation 30 (LODR)-Trading Plan under SEBI (PIT) Regulations 2015

11-Nov-2025 | Source : BSESubmission of restated trading plan wrt clarity price action based execution.

Corporate Actions

No Upcoming Board Meetings

Chemfab Alkalis Ltd has declared 12% dividend, ex-date: 04 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.07%)

Held by 2 FIIs (0.0%)

Dr Rao Holdings Pte Ltd (47.07%)

V. M. Srinivasan (1.81%)

21.61%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -16.36% vs -0.84% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -178.82% vs 127.75% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.10% vs -0.14% in Sep 2024

Growth in half year ended Sep 2025 is 50.00% vs -97.39% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.20% vs -5.07% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -89.29% vs -57.60% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 2.16% vs -1.23% in Mar 2024

YoY Growth in year ended Mar 2025 is -126.37% vs -59.24% in Mar 2024