Compare Chemtech Indust. with Similar Stocks

Stock DNA

Industrial Manufacturing

INR 126 Cr (Micro Cap)

16.00

26

0.00%

-0.67

7.54%

1.25

Total Returns (Price + Dividend)

Chemtech Indust. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

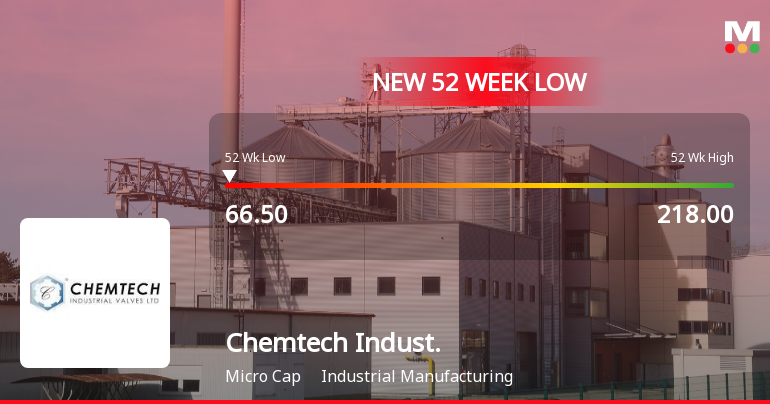

Chemtech Industrial Valves Ltd Falls to 52-Week Low Amidst Continued Downtrend

Chemtech Industrial Valves Ltd has declined to a fresh 52-week low of Rs.66.5, marking a significant downturn in its stock performance amid broader market gains and sectoral advances.

Read full news article

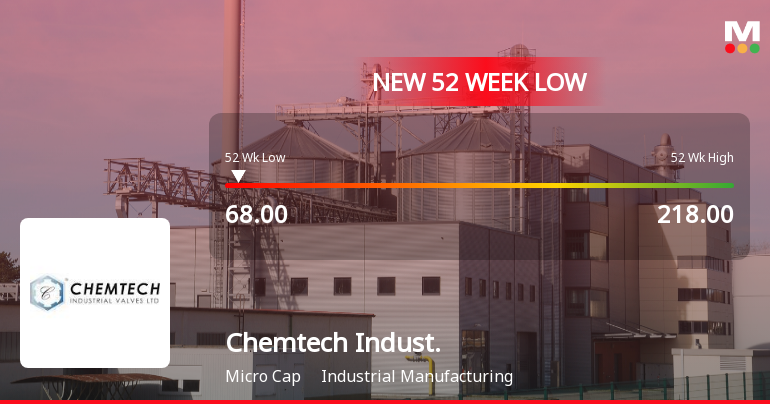

Chemtech Industrial Valves Ltd Falls to 52-Week Low of Rs.68

Chemtech Industrial Valves Ltd has reached a new 52-week low of Rs.68, marking a significant decline amid a challenging market environment. The stock has underperformed both its sector and broader market indices, reflecting ongoing pressures on its financial performance and valuation metrics.

Read full news article

Chemtech Industrial Valves Ltd is Rated Strong Sell

Chemtech Industrial Valves Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 15 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trend, and technical outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

15-Jan-2026 | Source : BSEKindly find enclosed herewith the Compliance Certificate under Reg 74(5) of SEBI (DP) Regulations 2018 as received from the RTA Bigshare Services Private Limited for the Quarter ended December 31 2025.

Closure of Trading Window

29-Dec-2025 | Source : BSEIntimation regarding closure of Trading Window for declaration of the Unaudited Financials for the Quarter ended 31st December 2025

Announcement under Regulation 30 (LODR)-Investor Presentation

21-Nov-2025 | Source : BSEInvestor Presentation - H1 FY2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 1 Schemes (1.58%)

Held by 0 FIIs

Harsh Pradeep Badkur (12.47%)

Vikas Vijaykumar Khemani (8.36%)

48.04%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -39.93% vs 84.97% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -21.15% vs 183.64% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -24.55% vs 90.49% in Sep 2024

Growth in half year ended Sep 2025 is 13.10% vs 94.79% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 31.95% vs 78.32% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 74.09% vs 713.51% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 27.60% vs 53.67% in Mar 2024

YoY Growth in year ended Mar 2025 is 69.16% vs 48.75% in Mar 2024