Compare Cranex with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 7.21%

- Poor long term growth as Net Sales has grown by an annual rate of 9.10% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 8.44 times

Flat results in Sep 25

Underperformed the market in the last 1 year

Stock DNA

Industrial Manufacturing

INR 56 Cr (Micro Cap)

30.00

31

0.00%

0.73

7.76%

2.20

Total Returns (Price + Dividend)

Cranex for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Cranex Ltd Investment Rating Upgraded to Sell Amid Mixed Technical and Fundamental Signals

Cranex Ltd, a key player in the industrial manufacturing sector, has seen its investment rating upgraded from Strong Sell to Sell as of 23 January 2026. This change is primarily driven by a shift in technical indicators, despite persistent challenges in the company’s financial performance and valuation metrics. The nuanced upgrade reflects a complex interplay of quality, valuation, financial trends, and technical signals that investors should carefully consider.

Read full news article

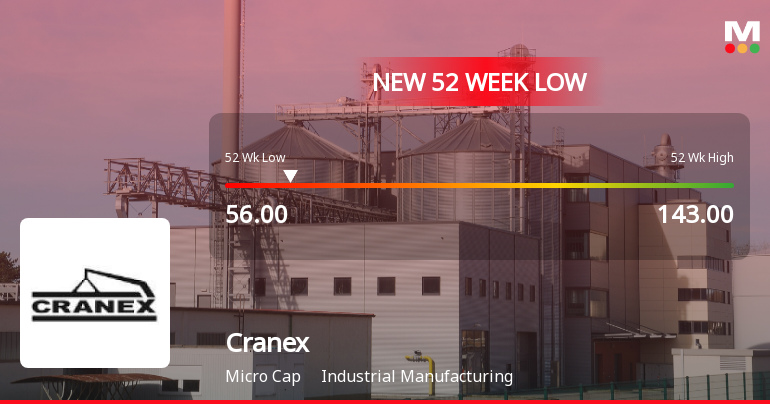

Cranex Ltd Stock Falls to 52-Week Low of Rs.56 Amidst Continued Downtrend

Cranex Ltd, a player in the Industrial Manufacturing sector, recorded a fresh 52-week low of Rs.56 on 22 Jan 2026, marking a significant decline amid a sustained downward trend. The stock underperformed its sector and broader market indices, reflecting ongoing pressures on its valuation and financial metrics.

Read full news article

Cranex Ltd Stock Falls to 52-Week Low of Rs.57.45 Amidst Market Downturn

Cranex Ltd, a player in the Industrial Manufacturing sector, recorded a new 52-week low of Rs.57.45 today, marking a significant decline in its stock price amid broader market weakness and company-specific headwinds.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

20-Jan-2026 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 and the relevant amendment thereto from time to time we would like to inform you that the company has received Purchase Orders for manufacturing and supply of various product with order value amounting to Rs. 74298925/-.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSEPlease find attached herewith the certificate issued under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 by M/s. Beetal Financial & Computer Services (P) LTD. RTA of the Company for the quarter ended 31st December 2025.

Closure of Trading Window

29-Dec-2025 | Source : BSEIntimation of Closure of Trading Window of the Company for the Third Quarter ended on 31st December 2025.

Corporate Actions

10 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Piyush Agrawal (39.47%)

Hitesh Ramji Javeri (2.62%)

47.39%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 1.06% vs -10.91% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -5.71% vs 79.49% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 0.90% vs -6.93% in Sep 2024

Growth in half year ended Sep 2025 is 0.00% vs 69.81% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -19.12% vs 62.11% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 57.14% vs 142.31% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -17.02% vs 50.10% in Mar 2024

YoY Growth in year ended Mar 2025 is 30.00% vs 167.86% in Mar 2024