Dashboard

Poor long term growth as Operating profit has grown by an annual rate -4.80% of over the last 5 years

Flat results in Sep 25

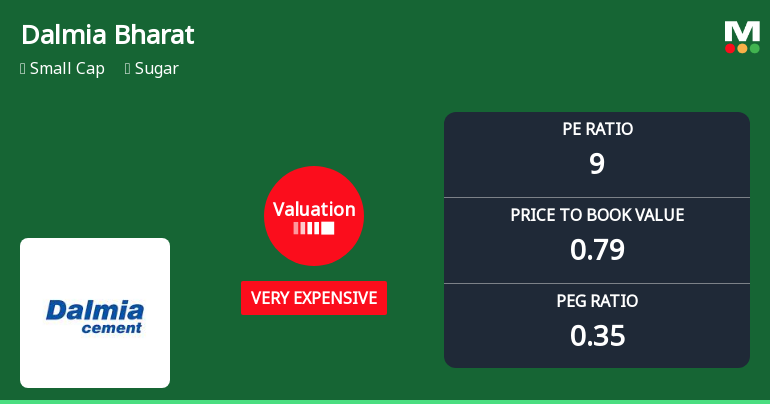

With ROE of 9, it has a Expensive valuation with a 0.8 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0.01% of the company

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Jun-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

Dalmia Bharat’s Evaluation Metrics Revised Amidst Sector Challenges and Market Underperformance

Dalmia Bharat’s recent assessment has undergone a revision reflecting shifts in its fundamental and technical outlook. The changes stem from a combination of valuation concerns, subdued financial trends, and bearish technical indicators, set against a backdrop of persistent underperformance within the sugar sector and the broader market.

Read More

Dalmia Bharat Sugar & Industries: Valuation Shifts and Market Position Analysis

Dalmia Bharat Sugar & Industries has experienced notable changes in its valuation parameters, reflecting a shift in market assessment. This article examines the company’s current price-to-earnings (P/E) ratio, price-to-book value (P/BV), and other key financial metrics in comparison to historical data and peer averages within the sugar industry.

Read More

Dalmia Bharat Sugar & Industries: Valuation Shifts and Market Position Analysis

Dalmia Bharat Sugar & Industries has experienced a notable revision in its valuation parameters, reflecting a shift in market assessment within the sugar sector. This article examines the recent changes in key financial metrics such as price-to-earnings (P/E) and price-to-book value (P/BV) ratios, comparing them with historical data and peer averages to provide a comprehensive view of the stock’s price attractiveness.

Read More Announcements

Apportionment Of Cost Of Acquisition Of Equity Shares Of Dalmia Bharat Sugar And Industries Limited And Dalmia Bharat Refractories Limited.

18-Dec-2025 | Source : BSEApportionment of cost of acquisition of Equity Shares of Dalmia Bharat Sugar and Industries Limited and Dalmia Bharat Refractories Limited.

Announcement under Regulation 30 (LODR)-Credit Rating

12-Dec-2025 | Source : BSERating letter dated December 12 2025 of ICRA Limited.

Announcement under Regulation 30 (LODR)-Credit Rating

20-Nov-2025 | Source : BSEICRA Limited has assigned A1+ rating to Commercial Paper of Rs. 500 Crore.

Corporate Actions

No Upcoming Board Meetings

Dalmia Bharat Sugar & Industries Ltd has declared 75% dividend, ex-date: 30 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.0%)

Held by 54 FIIs (0.97%)

Samagama Holdings And Commercial Private Limited (44.32%)

Anil Kumar Goel (5.23%)

20.33%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.08% vs -7.56% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -40.59% vs -80.98% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 3.09% vs 19.54% in Sep 2024

Growth in half year ended Sep 2025 is -41.75% vs -7.58% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 26.92% vs -0.60% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -0.40% vs -24.56% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 28.47% vs -10.85% in Mar 2024

YoY Growth in year ended Mar 2025 is 34.14% vs 8.96% in Mar 2024