Compare DENSO Corp. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 6.90%

- The company has been able to generate a Return on Equity (avg) of 6.90% signifying low profitability per unit of shareholders funds

Company's ability to service its debt is strong with a healthy EBIT to Interest (avg) ratio of 29.69

Low Debt Company with Strong Long Term Fundamental Strength

Negative results in Jun 25

With ROE of 9.35%, it has a very attractive valuation with a 1.11 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Auto Components & Equipments

JPY 6,353,213 Million (Large Cap)

12.00

NA

0.00%

-0.06

9.39%

1.32

Total Returns (Price + Dividend)

DENSO Corp. for the last several years.

Risk Adjusted Returns v/s

News

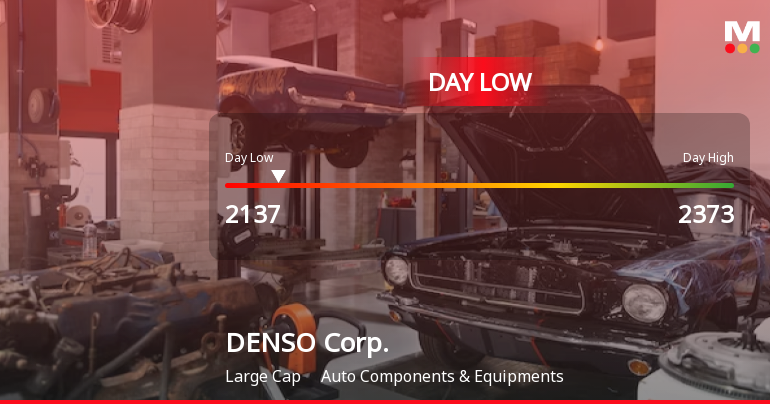

DENSO Corp. Stock Hits Day Low Amid Price Pressure, Closes at JPY 2,137.00

DENSO Corp. faced a notable stock decline today, reflecting ongoing market challenges. Despite a year-over-year profit increase, the company's return on equity indicates low profitability. DENSO's debt management appears strong, yet its long-term performance has significantly lagged behind the Japan Nikkei 225, raising concerns among stakeholders.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Mar 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 0 Schemes (0%)

Held by 1 Foreign Institutions (0.0%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is -6.36% vs 3.29% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is -30.28% vs -3.61% in Mar 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.24% vs 11.61% in Mar 2024

YoY Growth in year ended Mar 2025 is 30.85% vs 2.22% in Mar 2024