Compare Diageo Plc with Similar Stocks

Dashboard

High Debt Company with a Debt to Equity ratio (avg) at times

- Poor long term growth as Operating profit has grown by an annual rate 4.95% of over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at times

Poor long term growth as Operating profit has grown by an annual rate 4.95% of over the last 5 years

Negative results in Jun 25

With ROE of 31.50%, it has a expensive valuation with a 4.92 Price to Book Value

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Diageo Plc for the last several years.

Risk Adjusted Returns v/s

News

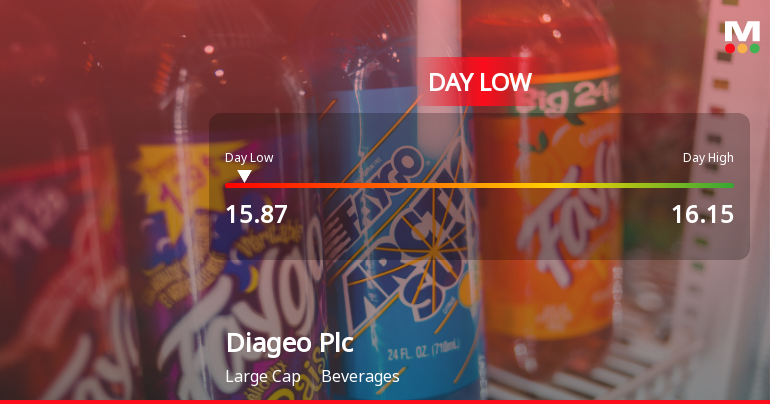

Diageo Plc Hits Day Low of GBP 15.87 Amid Price Pressure

Diageo Plc's stock faced a notable decline, reaching an intraday low amid ongoing market challenges. The company has experienced significant drops in both weekly and monthly performance, alongside a substantial year-to-date decrease. High debt levels and a premium price-to-book ratio further complicate its financial outlook against the FTSE 100 benchmark.

Read full news article

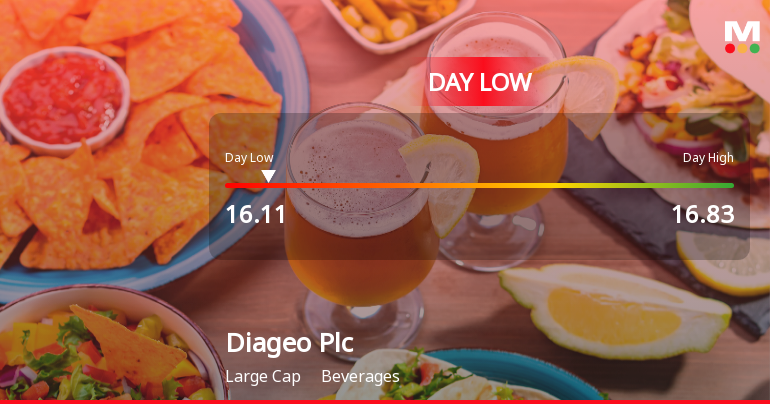

Diageo Plc Hits Day Low of GBP 16.11 Amid Price Pressure

Diageo Plc has faced significant stock declines, contrasting with the FTSE 100's gains. Year-to-date, the company has seen a notable downturn, alongside challenges reflected in its financial metrics, including a high debt-to-equity ratio and a decrease in profits, indicating ongoing struggles in a competitive market.

Read full news article

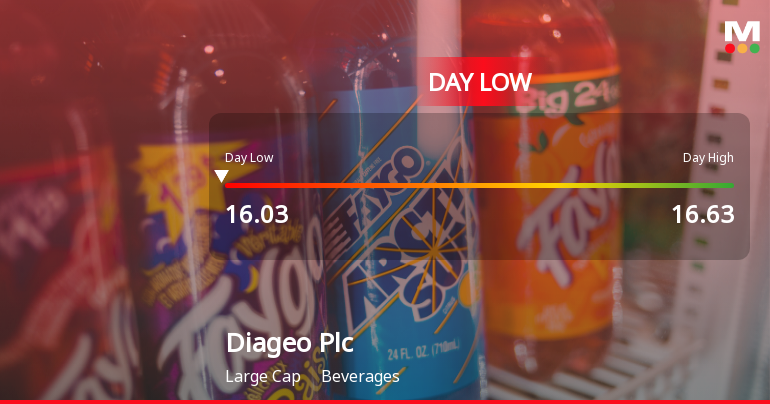

Diageo Plc Hits Day Low of GBP 16.02 Amid Price Pressure

Diageo Plc has faced notable challenges, with its stock declining significantly today and over the past week and year. The company struggles with high debt levels and modest operating profit growth, while its performance has consistently lagged behind the FTSE 100, raising concerns about its market position.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Jun 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 0 Schemes (0%)

Held by 11 Foreign Institutions (0.29%)

Annual Results Snapshot (Consolidated) - Jun'23

YoY Growth in year ended Jun 2023 is 10.75% vs 21.35% in Jun 2022

YoY Growth in year ended Jun 2023 is 12.82% vs 19.26% in Jun 2022