Compare Dillard's, Inc. with Similar Stocks

Dashboard

1

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 39.82%

- Healthy long term growth as Operating profit has grown by an annual rate 49.94%

- Company has very low debt and has enough cash to service the debt requirements

2

With ROE of 31.07%, it has a attractive valuation with a 26.06 Price to Book Value

3

High Institutional Holdings at 72.49%

4

Market Beating performance in long term as well as near term

Total Returns (Price + Dividend)

TimePeriod

Price Return

Dividend Return

Total Return

3 Months

66.85%

0%

66.85%

6 Months

34.92%

0%

34.92%

1 Year

48.07%

0%

48.07%

2 Years

82.88%

0%

82.88%

3 Years

107.52%

0%

107.52%

4 Years

277.03%

0%

277.03%

5 Years

1896.63%

0%

1896.63%

Dillard's, Inc. for the last several years.

Risk Adjusted Returns v/s

News

Dillard's, Inc. Experiences Revision in Stock Evaluation Amid Mixed Financial Performance

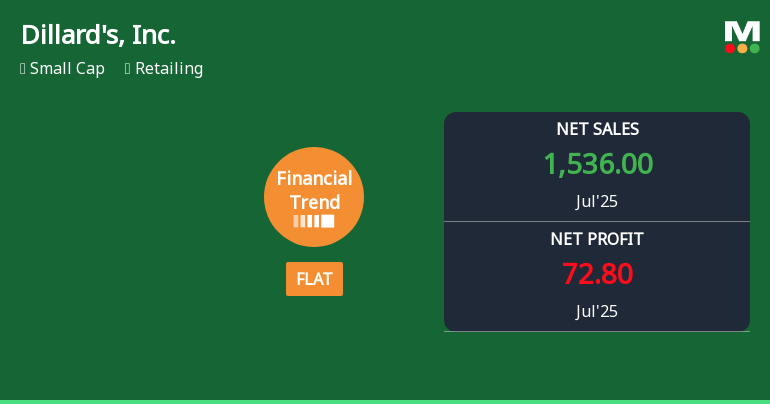

Dillard's, Inc. reported flat financial performance for the quarter ending July 2025, highlighting both strengths and weaknesses. The company maintains a low debt-equity ratio and substantial cash reserves, but faces challenges with low return on capital and inventory turnover. Its stock has outperformed the S&P 500 year-to-date.

Read full news article Announcements

No announcement available

Corporate Actions

No corporate action available

Quality key factors

Factor

Value

Sales Growth (5y)

5.01%

EBIT Growth (5y)

49.94%

EBIT to Interest (avg)

100.00

Debt to EBITDA (avg)

0

Net Debt to Equity (avg)

-0.34

Sales to Capital Employed (avg)

2.82

Tax Ratio

18.53%

Dividend Payout Ratio

2.72%

Pledged Shares

0

Institutional Holding

71.91%

ROCE (avg)

67.78%

ROE (avg)

39.82%

Valuation key factors

Factor

Value

P/E Ratio

84

Industry P/E

Price to Book Value

26.06

EV to EBIT

66.23

EV to EBITDA

53.23

EV to Capital Employed

38.81

EV to Sales

7.28

PEG Ratio

NA

Dividend Yield

91.48%

ROCE (Latest)

58.60%

ROE (Latest)

31.07%

Technicals key factors

Indicator

Weekly

Monthly

MACD

Mildly Bearish

Bullish

RSI

No Signal

No Signal

Bollinger Bands

Sideways

Bullish

Moving Averages

Mildly Bullish (Daily)

KST

Mildly Bearish

Bullish

Dow Theory

Mildly Bullish

No Trend

OBV

Mildly Bullish

Mildly Bullish

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Majority shareholders

Domestic Funds

Domestic Funds

Held in 67 Schemes (15.1%)

Foreign Institutions

Held by 128 Foreign Institutions (3.08%)

Strategic Entities with highest holding

Highest Public shareholder

Quarterly Results Snapshot (Consolidated) - Oct'25 - YoY

Oct'25

Oct'24

Change(%)

Net Sales

1,491.00

1,451.20

2.74%

Operating Profit (PBDIT) excl Other Income

214.60

208.10

3.12%

Interest

0.00

0.00

Exceptional Items

0.00

0.00

Consolidate Net Profit

129.80

124.60

4.17%

Operating Profit Margin (Excl OI)

114.10%

113.00%

0.11%

USD in Million.

Net Sales

YoY Growth in quarter ended Oct 2025 is 2.74% vs -3.52% in Oct 2024

Consolidated Net Profit

YoY Growth in quarter ended Oct 2025 is 4.17% vs -19.77% in Oct 2024

Annual Results Snapshot (Consolidated) - Jan'25

Jan'25

Jan'24

Change(%)

Net Sales

6,590.20

6,874.40

-4.13%

Operating Profit (PBDIT) excl Other Income

918.00

1,104.30

-16.87%

Interest

39.90

40.60

-1.72%

Exceptional Items

0.00

0.00

Consolidate Net Profit

593.50

738.80

-19.67%

Operating Profit Margin (Excl OI)

112.30%

134.50%

-2.22%

USD in Million.

Net Sales

YoY Growth in year ended Jan 2025 is -4.13% vs -1.74% in Jan 2024

Consolidated Net Profit

YoY Growth in year ended Jan 2025 is -19.67% vs -17.14% in Jan 2024

About Dillard's, Inc.

Dillard's, Inc.

Retailing

Dillard's, Inc. is a retailer of fashion apparel, cosmetics and home furnishing. As of January 28, 2017, the Company operated 293 Dillard's stores, including 25 clearance centers, and an Internet store offering a selection of merchandise, including fashion apparel for women, men and children, accessories, cosmetics, home furnishings and other consumer goods. The Company's segments include the Retail operations segment and the Construction segment. The Retail operations segment includes the operation of the Company's retail department stores. The Construction segment includes the operations of CDI Contractors, LLC (CDI), a general contracting construction company. CDI's business includes constructing and remodeling stores for the Company. As of January 28, 2017, the Company operated retail department stores in 29 states, primarily in the southwest, southeast and midwest regions of the United States.

Company Coordinates

Company Details

1600 Cantrell Rd , LITTLE ROCK AR : 72201

Registrar Details