Compare Ducon Tech with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 9.56%

- Poor long term growth as Net Sales has grown by an annual rate of 3.96% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.64 times

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Industrial Manufacturing

INR 106 Cr (Micro Cap)

8.00

26

0.00%

0.36

7.94%

0.60

Total Returns (Price + Dividend)

Ducon Tech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Ducon Infratechnologies Ltd is Rated Sell

Ducon Infratechnologies Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 08 Aug 2025, reflecting a shift from a previous 'Strong Sell' stance. However, all fundamentals, returns, and financial metrics discussed here are current as of 29 January 2026, providing investors with an up-to-date assessment of the stock's position.

Read full news article

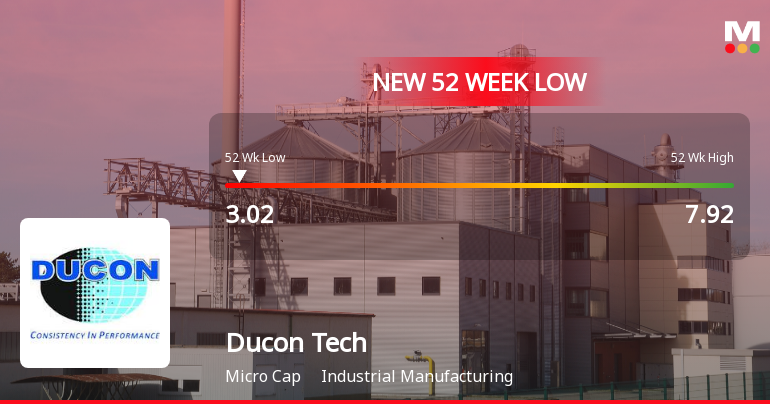

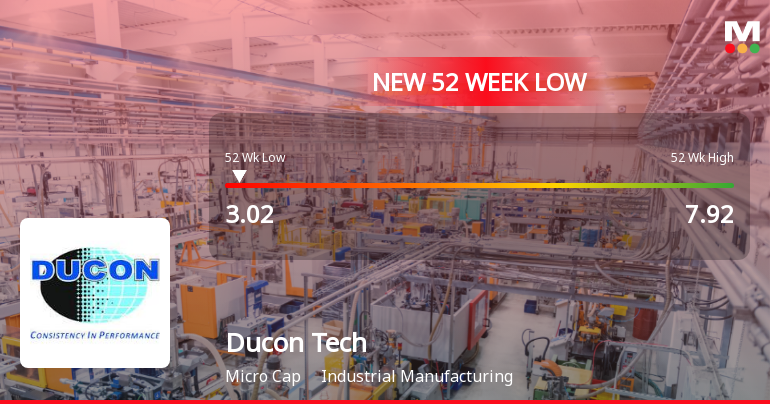

Ducon Infratechnologies Ltd Falls to 52-Week Low of Rs.3.02

Shares of Ducon Infratechnologies Ltd have declined to a fresh 52-week low of Rs.3.02 on 20 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. This new low reflects a sustained period of price weakness amid broader market volatility and sectoral pressures.

Read full news article

Ducon Infratechnologies Ltd Falls to 52-Week Low of Rs.3.02 Amid Continued Downtrend

Ducon Infratechnologies Ltd has touched a fresh 52-week low of Rs.3.02 today, marking a significant decline amid a sustained downward trajectory. The stock has now recorded losses over the past three consecutive sessions, reflecting ongoing pressures within the industrial manufacturing sector.

Read full news article Announcements

Ducon Infratechnologies Limited - Clarification - Financial Results

03-Dec-2019 | Source : NSEDucon Infratechnologies Limitednologies Limited for the quarter ended 30-Sep-2019 with respect to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Ducon Infratechnologies Limited - Updates

13-Nov-2019 | Source : NSEDucon Infratechnologies Limited has informed the Exchange regarding 'Revised Disclosures under Regulation 29(1) & (2) of SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2011

Updates

16-Sep-2019 | Source : NSE

| Ducon Infratechnologies Limited has informed the Exchange regarding 'In terms of Regulation 47 of SEBI (LODR) Regulations, 2015, the Company forwards herewith a copy of the Notice regarding 10th Annual General Meeting of the company published in the newspapers.'. |

Corporate Actions

12 Feb 2026

No Dividend history available

No Splits history available

Ducon Infratechnologies Ltd has announced 1:10 bonus issue, ex-date: 18 Apr 22

Ducon Infratechnologies Ltd has announced 1:4 rights issue, ex-date: 30 Aug 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Arun Govil (38.08%)

Pratik Banji Dabhi (2.72%)

55.32%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 0.95% vs -5.40% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 17.89% vs -13.30% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 2.93% vs 10.14% in Sep 2024

Growth in half year ended Sep 2025 is 4.44% vs 363.12% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 6.62% vs 6.79% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 119.91% vs 15.01% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.84% vs 5.90% in Mar 2024

YoY Growth in year ended Mar 2025 is 77.59% vs 86.10% in Mar 2024