Compare Edible Garden AG , Inc. with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate -242.34% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -5.34

- OPERATING CASH FLOW(Y) Lowest at USD -9.63 MM

- INTEREST(HY) At USD 0.83 MM has Grown at 54.66%

- INVENTORY TURNOVER RATIO(HY) Lowest at 9.64 times

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Other Agricultural Products

USD 3 Million (Micro Cap)

NA (Loss Making)

NA

0.00%

0.13

-109.98%

0.23

Total Returns (Price + Dividend)

Edible Garden AG , Inc. for the last several years.

Risk Adjusted Returns v/s

News

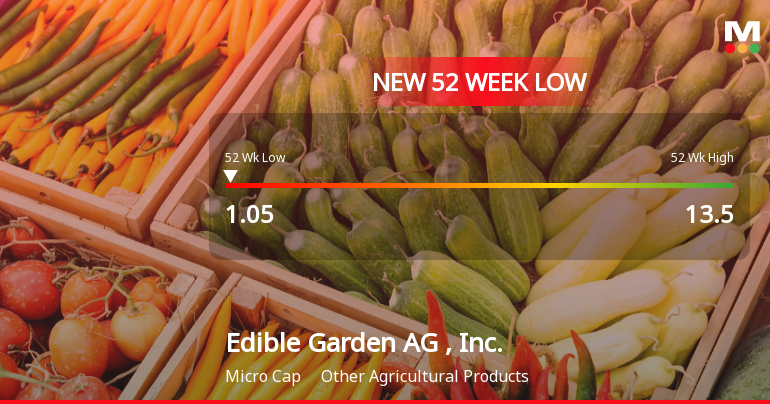

Edible Garden AG, Inc. Hits New 52-Week Low at $1.04

Edible Garden AG, Inc. has reached a new 52-week low, reflecting a challenging year marked by a significant stock price decline. The company faces ongoing financial difficulties, including negative return on equity, high operating losses, and low inventory turnover, indicating operational inefficiencies and a precarious financial position.

Read full news article

Edible Garden AG, Inc. Hits New 52-Week Low at $1.05

Edible Garden AG, Inc. has reached a new 52-week low, reflecting a challenging year with a significant stock price decline. The company faces ongoing financial difficulties, including a negative return on equity and an alarming drop in operating profit, raising concerns about its ability to manage debt and ensure long-term viability.

Read full news article

Edible Garden AG, Inc. Hits New 52-Week Low at $1.21

Edible Garden AG, Inc. has reached a new 52-week low, reflecting ongoing struggles with a one-year performance decline of 29.24%. The company, with a market capitalization of USD 5 million, has not reported earnings and faces significant financial challenges, including negative operating cash flow and a steep decline in annual operating profit.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 2 Schemes (0.52%)

Held by 4 Foreign Institutions (0.14%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 7.69% vs -21.21% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -90.48% vs 12.50% in Sep 2024

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is -0.71% vs 20.69% in Dec 2023

YoY Growth in year ended Dec 2024 is -8.82% vs 18.40% in Dec 2023