Compare Elnet Technolog with Similar Stocks

Stock DNA

Computers - Software & Consulting

INR 140 Cr (Micro Cap)

7.00

26

0.54%

-0.47

11.96%

0.85

Total Returns (Price + Dividend)

Latest dividend: 1.8999999999999997 per share ex-dividend date: Sep-01-2025

Risk Adjusted Returns v/s

Returns Beta

News

Elnet Technologies Ltd is Rated Sell

Elnet Technologies Ltd is rated Sell by MarketsMOJO, with this rating last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 09 February 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news articleAre Elnet Technologies Ltd latest results good or bad?

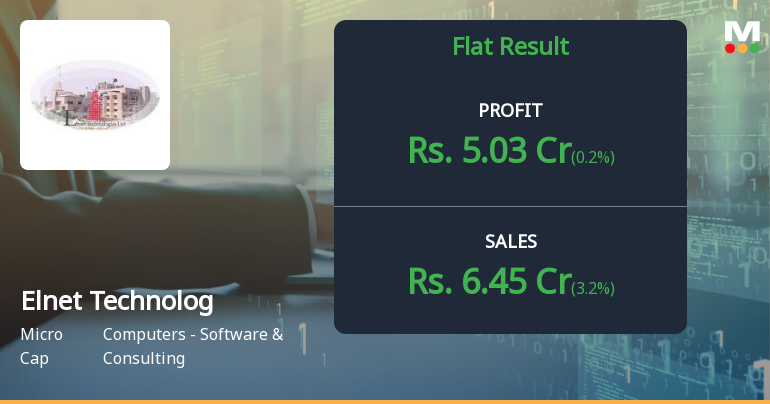

Elnet Technologies Ltd's latest financial results for the quarter ended December 2025 reveal a complex picture of operational performance. The company achieved record quarterly revenue of ₹6.45 crores, reflecting a 3.20% increase from the previous quarter and a 9.69% rise year-over-year. This revenue growth is notable, yet it remains modest in scale compared to the broader software and consulting sector, which has experienced more robust growth. Operating margins have reached a record high of 67.29%, indicating effective cost management, particularly in employee expenses, which remained stable despite revenue growth. However, the profit after tax (PAT) margin showed a decline to 77.98%, down from the previous quarter, suggesting some pressures on profitability. Net profit for the quarter was reported at ₹5.03 crores, reflecting a slight increase of 0.20% from the previous quarter and a more substantial ye...

Read full news article

Elnet Technologies Q3 FY26: Modest Growth Masked by Declining Returns and Bearish Technicals

Elnet Technologies Limited, the Chennai-based software technology park operator, reported its Q3 FY26 results with net profit of ₹5.03 crores, marking a marginal 0.20% quarter-on-quarter increase but a healthier 16.44% year-on-year growth. The micro-cap stock, currently trading at ₹340.15 with a market capitalisation of ₹134 crores, has struggled over the past year with a 22.20% decline, significantly underperforming the Sensex's 6.44% gain during the same period.

Read full news article Announcements

Newspaper Advertisement For Q3 Ended 31.12.2025 Unaudited Financial Results FY 2025- 26 Elnet

06-Feb-2026 | Source : BSEPlease find the attached document.

Unaudited Financial Results For The Quarter And Nine Months Ended December 31 2025 Of Elnet Technologies Limited

06-Feb-2026 | Source : BSEPlease find attached the document

Shareholder Meeting / Postal Ballot-Scrutinizers Report

05-Feb-2026 | Source : BSEPursuant to Regulation 44(3) of SEBI LODR the voting results along with the consolidated scrutinizers report has been submitted. All resolutions set out in the notice has been duly approved by the shareholders with requisite majority.

Corporate Actions

No Upcoming Board Meetings

Elnet Technologies Ltd has declared 19% dividend, ex-date: 01 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Electronics Corporation Of Tamilnadu Ltd (26.0%)

Sangeetha S (3.36%)

38.66%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 3.20% vs 2.63% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 0.20% vs 0.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 3.44% vs -11.57% in Sep 2024

Growth in half year ended Sep 2025 is 18.12% vs -2.07% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 5.51% vs -12.14% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 17.55% vs -4.61% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -11.93% vs 6.26% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.34% vs 27.76% in Mar 2024