Compare Embassy Develop with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 11.02% and Operating profit at 17.21% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -18.11

Negative results in Sep 25

With ROCE of 0.1, it has a Expensive valuation with a 0.9 Enterprise value to Capital Employed

47.75% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Stock DNA

Realty

INR 8,900 Cr (Small Cap)

NA (Loss Making)

35

0.00%

0.35

-1.80%

0.89

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: May-06-2014

Risk Adjusted Returns v/s

Returns Beta

News

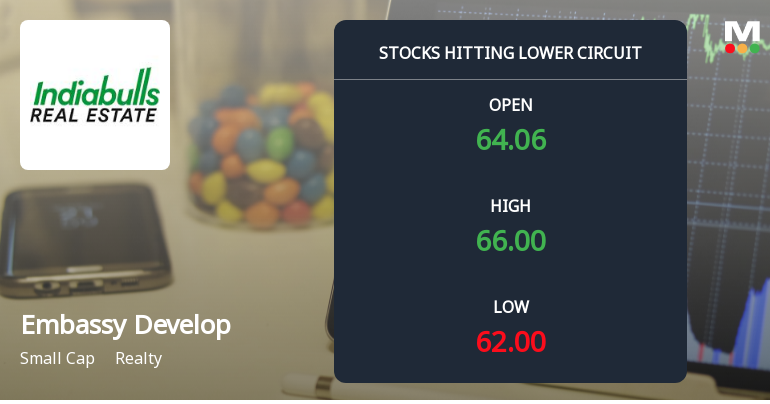

Embassy Developments Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Embassy Developments Ltd, a key player in the realty sector, witnessed intense selling pressure on 2 Feb 2026, culminating in the stock hitting its lower circuit limit. The share price plunged by 4.86%, closing at ₹62.10, marking a maximum daily loss that reflects mounting investor concerns amid subdued market sentiment.

Read full news article

Embassy Developments Ltd is Rated Strong Sell

Embassy Developments Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 July 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 31 January 2026, providing investors with an up-to-date perspective on the stock’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

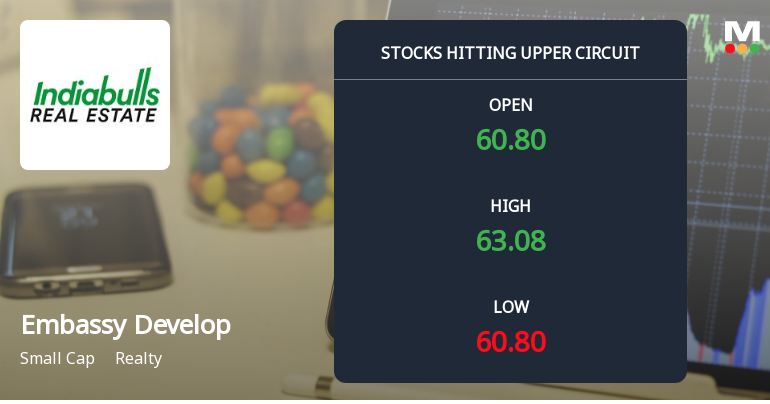

Embassy Developments Ltd Hits Upper Circuit Amid Strong Buying Pressure

Embassy Developments Ltd surged to hit its upper circuit limit on 29 Jan 2026, closing at ₹63.09, marking a maximum daily gain of 4.99%. This sharp rally was driven by robust buying interest, resulting in a regulatory freeze on further transactions and highlighting significant unfilled demand in the stock.

Read full news article Announcements

Indiabulls Real Estate Limited - Other General Purpose

09-Dec-2019 | Source : NSEIndiabulls Real Estate Limited has informed the Exchange regarding Compliance Under Regulation 23(9) of the SEBI (LODR) Regulations 2015.

Indiabulls Real Estate Limited - Updates

04-Nov-2019 | Source : NSEIndiabulls Real Estate Limited has informed the Exchange regarding 'In furtherance to intimations dated April 23, 2019 and August 14, 2019, please be informed that pursuant to and in terms of the authorization of shareholders of the Company vide special resolution passed at Annual General Meeting held on 28th September 2019 with almost 100% favorable votes without participation of the promoters and promoter group, the Company s wholly owned subsidiary has divested its entire stake in Century Limited, which indirectly owns Hanover Square property, London ( London Property ), to Clivedale Overseas Limited, an entity owned by the Promoters of the Company. With this, the Century Limited ceases to be a subsidiary of the Company. The details, in terms of Regulation 30 of SEBI LODR read with SEBI Circular no CIR/CFD/CMD/4/2015, dated September 9, 2015, are attached.

Indiabulls Real Estate Limited - Credit Rating

31-Oct-2019 | Source : NSEIndiabulls Real Estate Limited has informed the Exchange regarding Credit Rating. Indiabulls Real Estate Limited has been assigned long term rating of IVR AA- and short term rating of IVR A1+ by Infomerics Valuation and Rating.

Corporate Actions

No Upcoming Board Meetings

Embassy Developments Ltd has declared 50% dividend, ex-date: 06 May 14

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

47.7469

Held by 9 Schemes (2.83%)

Held by 129 FIIs (25.3%)

Jv Holding Private Limited (17.49%)

Ncl Sg Holdings Pte Ltd (7.96%)

20.72%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -27.58% vs -23.43% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 7.56% vs -228.04% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 21.62% vs 230.33% in Sep 2024

Growth in half year ended Sep 2025 is -462.08% vs 112.63% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 228.59% vs -17.94% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 109.09% vs -216.98% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 83.48% vs 102.48% in Mar 2024

YoY Growth in year ended Mar 2025 is 140.12% vs 18.23% in Mar 2024