Compare Epuja Spiritech with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 25 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.00

-3.60%

0.98

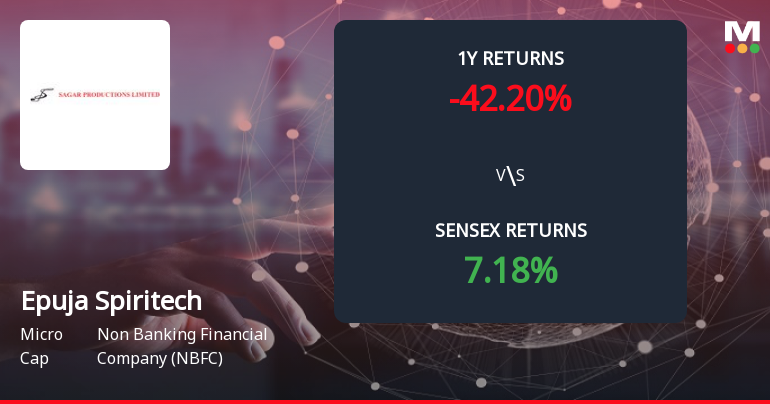

Total Returns (Price + Dividend)

Latest dividend: 0.02 per share ex-dividend date: Sep-20-2019

Risk Adjusted Returns v/s

Returns Beta

News

Epuja Spiritech Ltd Forms Death Cross, Signalling Potential Bearish Trend

Epuja Spiritech Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, has recently formed a Death Cross, a significant technical indicator where the 50-day moving average (DMA) crosses below the 200-DMA. This development signals a potential deterioration in the stock’s trend and raises concerns about sustained bearish momentum in the near to medium term.

Read full news article

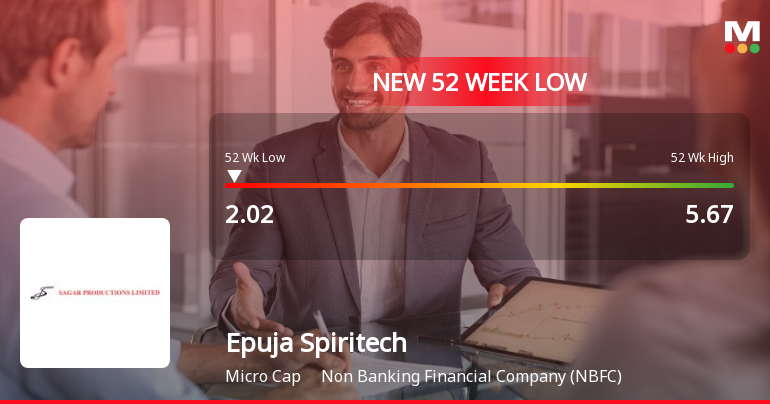

Epuja Spiritech Ltd Stock Hits 52-Week Low Amidst Continued Decline

Epuja Spiritech Ltd, a company operating within the Non Banking Financial Company (NBFC) sector, has reached a new 52-week low of Rs.2.03 today, marking a significant milestone in its ongoing downward trajectory. This fresh low comes after a sustained period of decline, reflecting a challenging phase for the stock amid broader market dynamics and company-specific factors.

Read full news article

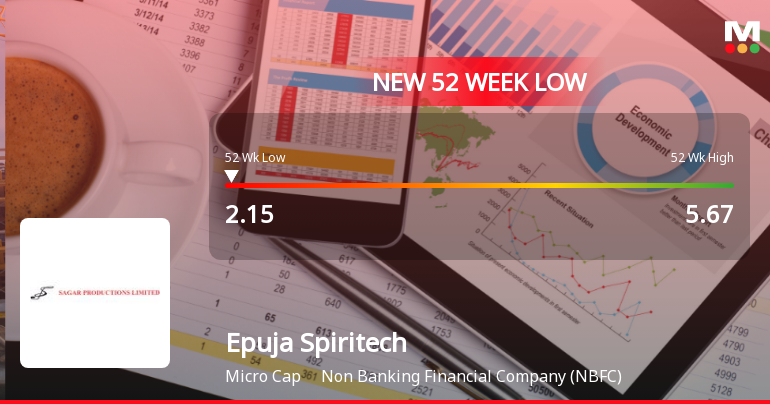

Epuja Spiritech Ltd Stock Hits 52-Week Low Amid Continued Downtrend

Epuja Spiritech Ltd, a Non Banking Financial Company (NBFC), touched a new 52-week low of Rs.2.15 today, marking a significant downturn in its stock performance. The stock has been on a persistent downward trajectory, reflecting ongoing concerns about the company’s financial health and market positioning.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

12-Jan-2026 | Source : BSEWe hereby submit Certificate under regulation 74(5) of SEBI (DP) Regulation 2018 for the quarter ended 31st December 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEClosure of trading window for the unaudited financial results quarter ended 31st December 2025.

Intimation For Grant Of Employee Stock Options Under Epuja Spiritech Employee Stock Option Scheme 2025 (ESOP 2025/ Scheme)

09-Dec-2025 | Source : BSEEnclosed herewith the intimation for grant of ESOPs

Corporate Actions

No Upcoming Board Meetings

Epuja Spiritech Ltd has declared 2% dividend, ex-date: 20 Sep 19

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 2 FIIs (0.38%)

Winfotel Infomedia Technologies Pvt Ltd (7.96%)

Shiva Kumar (6.21%)

75.63%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -78.72% vs 62.07% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -416.67% vs -2,500.00% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -62.90% vs 40.91% in Sep 2024

Growth in half year ended Sep 2025 is -190.63% vs -481.82% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 117.57% vs -47.89% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -1,011.11% vs 25.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 801.04% vs -31.91% in Mar 2024

YoY Growth in year ended Mar 2025 is 133.33% vs -118.18% in Mar 2024