Compare Expedia Group, Inc. with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 61.21%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0 times

Healthy long term growth as Operating profit has grown by an annual rate 46.32%

Positive results in Jun 25

With ROE of 111.76%, it has a attractive valuation with a 47.22 Price to Book Value

Stock DNA

Tour, Travel Related Services

USD 31,775 Million (Mid Cap)

42.00

NA

0.65%

-1.04

97.66%

23.77

Total Returns (Price + Dividend)

Expedia Group, Inc. for the last several years.

Risk Adjusted Returns v/s

News

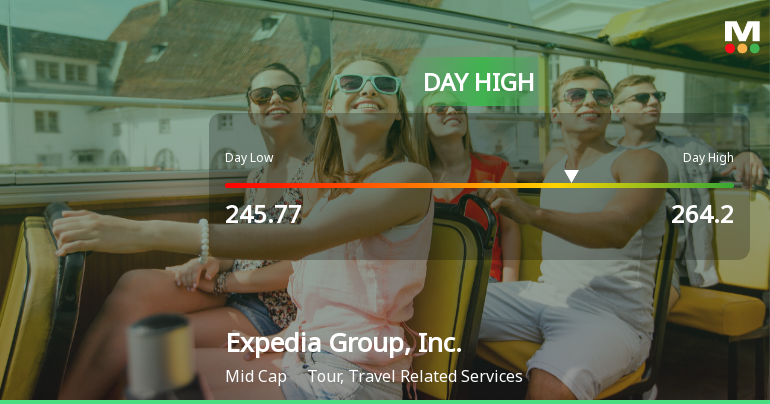

Expedia Group Stock Soars 17.55% to Intraday High of $264.20

Expedia Group, Inc. has shown remarkable stock performance, significantly outperforming the S&P 500. Over the past year, the company has achieved substantial growth, with impressive returns and high management efficiency. Its strong financial metrics and market capitalization reinforce its position in the travel services sector.

Read full news article

Expedia Group, Inc. Hits New 52-Week High of $264.20

Expedia Group, Inc. achieved a new 52-week high of USD 264.20 on November 7, 2025, reflecting strong performance in the travel industry with a one-year growth of 109.31%. The company has a market capitalization of USD 61,532 million and impressive financial metrics, indicating a solid balance sheet.

Read full news article

Expedia Group, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Performance Metrics

Expedia Group, Inc. has recently adjusted its valuation, with its current price reflecting a significant increase. Over the past year, the company has shown strong performance, significantly outperforming the S&P 500. Key financial metrics indicate a competitive position within the travel industry, despite some challenges in capital employed.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 155 Schemes (39.16%)

Held by 413 Foreign Institutions (21.91%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 8.67% vs 3.33% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 40.94% vs 124.26% in Sep 2024

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 6.64% vs 10.05% in Dec 2023

YoY Growth in year ended Dec 2024 is 77.91% vs 100.58% in Dec 2023