Compare F A C T with Similar Stocks

Dashboard

Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.60

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.60

Poor long term growth as Operating profit has grown by an annual rate -31.33% of over the last 5 years

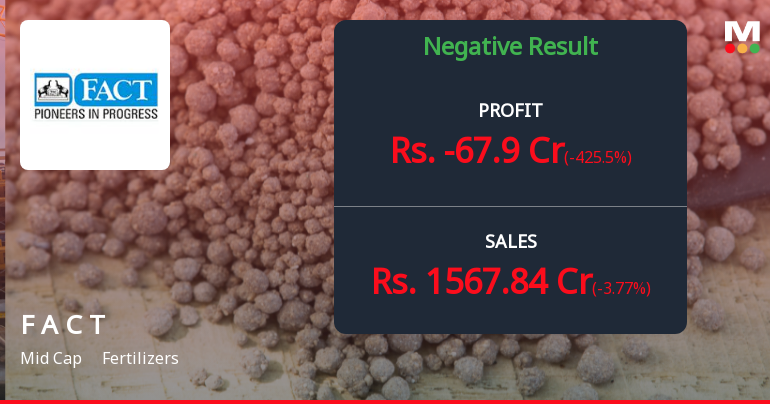

Negative results in Dec 25

With ROCE of 4.7, it has a Very Expensive valuation with a 18.1 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.42% of the company

Stock DNA

Fertilizers

INR 52,753 Cr (Mid Cap)

3,543.00

23

0.02%

1.17

6.60%

38.15

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

Fertilizers & Chemicals Travancore Ltd Reports Sharp Quarterly Decline Amid Rising Sales

Fertilizers & Chemicals Travancore Ltd (F A C T) has reported a significant deterioration in its financial performance for the quarter ended December 2025, with net sales growth overshadowed by steep losses and margin contraction. The company’s financial trend has shifted from flat to negative, reflecting mounting operational challenges and elevated leverage concerns.

Read full news articleAre Fertilizers & Chemicals Travancore Ltd latest results good or bad?

Fertilizers & Chemicals Travancore Ltd (FACT) has reported its Q3 FY26 results, which highlight significant operational challenges despite a year-on-year increase in net sales. The company recorded net sales of ₹1,567.84 crores, reflecting a 65.14% growth compared to the same quarter last year, but this was accompanied by a sequential decline of 3.77% from the previous quarter. The net profit for the quarter was a loss of ₹67.90 crores, marking a substantial decline of 425.50% compared to the prior quarter, raising concerns about the company's profitability and cost management. The operating margin (excluding other income) fell to negative 2.73%, the lowest recorded in eight quarters, indicating a collapse in operational efficiency. This negative margin contrasts sharply with the modest positive margins seen in earlier quarters, suggesting that rising costs have outpaced the benefits of increased sales vo...

Read full news article

FACT Q3 FY26: Fertiliser Giant Posts ₹67.90 Crore Loss Amid Margin Pressure

Fertilisers & Chemicals Travancore Ltd. (FACT), India's pioneering fertiliser manufacturer, reported a net loss of ₹67.90 crores for Q3 FY26, marking a dramatic reversal from the ₹20.86 crore profit posted in Q2 FY26. The loss represents a staggering 948.75% year-on-year decline compared to the ₹8.00 crore profit in Q3 FY25, sending shockwaves through the investor community.

Read full news article Announcements

Fertilizers and Chemicals Travancore Limited - Clarification - Financial Results

26-Nov-2019 | Source : NSEFertilizers and Chemicals Travancore Limited Chemicals Travancore Limited for the quarter ended 30-Sep-2019 with respect to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Updates

21-Sep-2019 | Source : NSE

| Fertilizers and Chemicals Travancore Limited has informed the Exchange regarding 'The Board accorded approval for implementation of CAPEX project to the extend of Rs 700 crore (maximum), by utilising the proceeds from proposed land monetisation to Government of Kerala . '. |

Shareholders meeting

21-Sep-2019 | Source : NSE

| Fertilizers and Chemicals Travancore Limited has informed the Exchange regarding Proceedings of Annual General Meeting held on September 20, 2019. Further, the company has submitted the Exchange a copy of Srutinizers report along with voting results. |

Corporate Actions

No Upcoming Board Meetings

Fertilizers & Chemicals Travancore Ltd has declared 2% dividend, ex-date: 19 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 46 Schemes (0.04%)

Held by 26 FIIs (0.21%)

The President Of India (90.0%)

Special National Investment Fund (8.56%)

0.71%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -3.77% vs 56.25% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -425.50% vs 387.38% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 30.46% vs -29.27% in Sep 2024

Growth in half year ended Sep 2025 is 167.06% vs -121.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 41.44% vs -24.93% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -45.00% vs -114.22% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -19.86% vs -18.44% in Mar 2024

YoY Growth in year ended Mar 2025 is -71.79% vs -76.15% in Mar 2024