Compare Fedders Holding with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 7.08%

The company has declared Negative results for the last 5 consecutive quarters

Despite the size of the company, domestic mutual funds hold only 0% of the company

Underperformed the market in the last 1 year

Stock DNA

Non Banking Financial Company (NBFC)

INR 957 Cr (Micro Cap)

35.00

23

0.00%

0.09

4.17%

1.46

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-19-2013

Risk Adjusted Returns v/s

Returns Beta

News

Fedders Holding Ltd is Rated Strong Sell

Fedders Holding Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

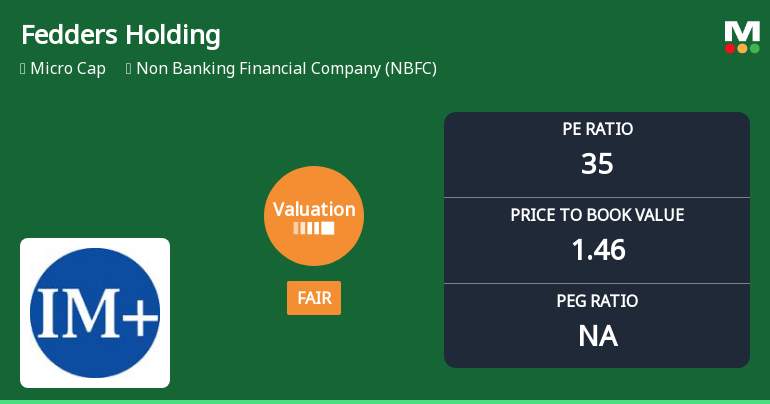

Fedders Holding Ltd Valuation Shifts to Fair Amidst Market Volatility

Fedders Holding Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has experienced a notable shift in its valuation parameters, moving from an expensive to a fair valuation grade. This transition, coupled with recent price movements and sector comparisons, offers investors a fresh perspective on the stock’s price attractiveness and potential investment appeal.

Read full news article

Fedders Holding Ltd is Rated Strong Sell

Fedders Holding Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 January 2026. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 22 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Intimation Of Board Meeting For The Quarter And Nine Months Ended December 31 2025

05-Feb-2026 | Source : BSEFedders Holding Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve Pursuant to Regulation 29(1)(a) Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (the said Regulations) this is to inform you that as required under Regulation 33 of the said Regulations a meeting of the Board of Directors of the Company is scheduled to be held on Friday February 13 2026 at the Registered office of the Company at C-15 RDC Raj Nagar Ghaziabad-201001 Uttar Pradesh interalia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) of the Company for the quarter and nine months ended December 31 2025 after the same are reviewed by the Audit Committee.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSEPlease find the attached RTA Certificate pursuant to Regulation 74(5) of SEBI(Depositories and Participants) Regulations 2018 for the quarter ended December 31 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEThe trading window shall remain closed for all Designated Persons/Insiders and their immediate relatives from Thursday January 01 2026 till 48 hours after the conclusion of the board meeting.

Corporate Actions

13 Feb 2026

Fedders Holding Ltd has declared 10% dividend, ex-date: 19 Sep 13

Fedders Holding Ltd has announced 1:10 stock split, ex-date: 20 Sep 24

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 2 FIIs (0.09%)

Tirupati Containers Private Limited (24.58%)

Nippon Tubes Limited (1.72%)

22.09%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -30.83% vs -29.20% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -12.45% vs 148.64% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -42.35% vs 14.83% in Sep 2024

Growth in half year ended Sep 2025 is 14.12% vs -31.69% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -18.06% vs 1,408.22% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -61.85% vs 3,816.35% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -19.16% vs 355.82% in Mar 2024

YoY Growth in year ended Mar 2025 is -59.74% vs 352.03% in Mar 2024