Compare Fine Line Cir. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 5.41%

- Poor long term growth as Net Sales has grown by an annual rate of 6.05% and Operating profit at 4.73% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.63

Flat results in Sep 25

With ROCE of 4.5, it has a Expensive valuation with a 3.4 Enterprise value to Capital Employed

Total Returns (Price + Dividend)

Latest dividend: 0.5000 per share ex-dividend date: Aug-16-2007

Risk Adjusted Returns v/s

Returns Beta

News

Fine Line Circuits Ltd: Valuation Shifts Signal Elevated Price Risk Amidst Strong Sell Rating

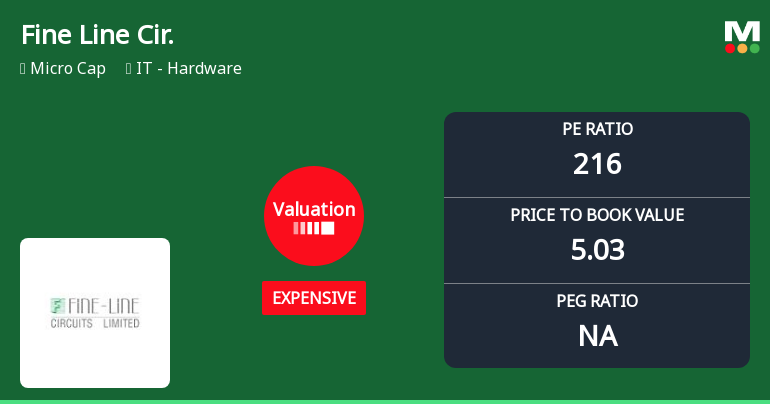

Fine Line Circuits Ltd has seen a marked shift in its valuation parameters, moving from a risky to an expensive classification, as reflected in its elevated price-to-earnings and price-to-book ratios. Despite strong long-term returns outperforming the Sensex, recent price declines and subdued profitability metrics raise questions about the stock’s price attractiveness in the IT hardware sector.

Read full news article

Fine Line Circuits Ltd is Rated Strong Sell

Fine Line Circuits Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 19 Nov 2025, reflecting a shift from the previous 'Sell' grade. However, the analysis and financial metrics discussed here represent the stock's current position as of 26 January 2026, providing investors with the latest insights into the company's performance and outlook.

Read full news article

Fine Line Circuits Ltd is Rated Strong Sell

Fine Line Circuits Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 19 Nov 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 14 January 2026, providing investors with the latest insights into the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Closure of Trading Window

27-Dec-2025 | Source : BSEClosure of Trading Window from 1st January 01.2026 till closure of 48 hours after the date of board meeting .

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Dec-2025 | Source : BSENewspaper Advertisement reagarding the opening of special window for relodgement of the transfer requests of Physical shares.

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Nov-2025 | Source : BSEUnaudited Financial Results for the quarter and half year ended 30.09.2025 published in Business standard and Mumbai Lakshdeep on 13.11.2025 are enclosed

Corporate Actions

No Upcoming Board Meetings

Fine Line Circuits Ltd has declared 5% dividend, ex-date: 16 Aug 07

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Bhagwandas Trikamdas Doshi (12.66%)

Upendranath Nimmagadda (9.78%)

49.72%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 33.10% vs 9.85% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 16.67% vs 400.00% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 20.79% vs 34.23% in Sep 2024

Growth in half year ended Sep 2025 is 18.18% vs 161.11% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 40.40% vs -16.02% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 950.00% vs -75.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 25.08% vs -11.58% in Mar 2024

YoY Growth in year ended Mar 2025 is 81.82% vs 57.14% in Mar 2024