Compare Flexituff Vent. with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.59 times

- The company has reported losses and also has negative networth. This is not a good sign for the investors. Either company will have to raise fresh capital or report profits to sustain going forward

The company has declared negative results for the last 13 consecutive quarters

Risky - Negative EBITDA

77% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Stock DNA

Garments & Apparels

INR 35 Cr (Micro Cap)

NA (Loss Making)

223

0.00%

-11.07

343.03%

-1.51

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-21-2015

Risk Adjusted Returns v/s

Returns Beta

News

Flexituff Ventures International Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Flexituff Ventures International Ltd, a micro-cap player in the Garments & Apparels sector, witnessed a sharp decline on 30 Jan 2026 as it hit its lower circuit price limit, reflecting intense selling pressure and panic among investors. The stock closed at ₹10.40, down 3.08% on the day, underperforming both its sector and the broader market benchmarks.

Read full news article

Flexituff Ventures International Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Flexituff Ventures International Ltd, a micro-cap player in the garments and apparels sector, witnessed a sharp decline on 29 Jan 2026, hitting its lower circuit limit with a maximum daily loss of 4.96%. The stock closed at ₹10.73, down ₹0.56 from the previous close, reflecting intense selling pressure and panic among investors.

Read full news article

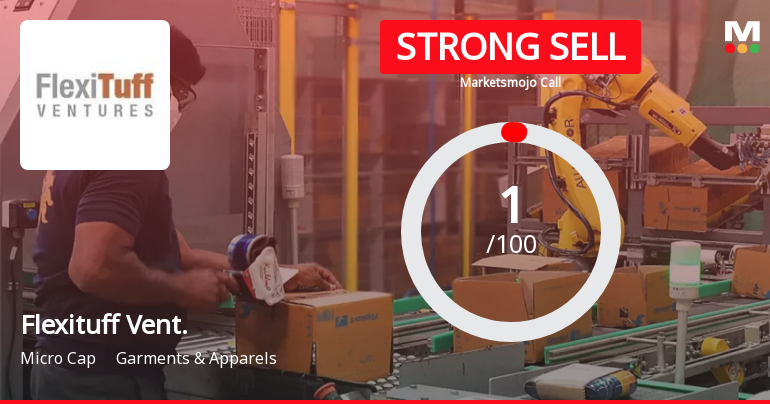

Flexituff Ventures International Ltd is Rated Strong Sell

Flexituff Ventures International Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 Jan 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article Announcements

Flexituff Ventures International Limited - Other General Purpose

03-Dec-2019 | Source : NSEFlexituff Ventures International Limited has informed the Exchange regarding Disclosure to Related Party Transaction pursuant to regulation 23(9) of Securities and Exchange Board of India (Listing Obligation and Disclosure Requirement) Regulations, 2015.

Flexituff Ventures International Limited - Clarification

18-Nov-2019 | Source : NSEFlexituff Ventures International Limited Limited with respect to announcement dated 14-Nov-2019, regarding Board meeting held on November 14, 2019. On basis of above the Company is required to clarify following: 1. Date of appointment/cessation (as applicable) & term of appointment 2. Confirmation from Independent Director that there are no material reasons other than provided 3. Detailed Reasons for Resignation. The response of the Company is awaited.

Flexituff Ventures International Limited - Outcome of Board Meeting

15-Nov-2019 | Source : NSEFlexituff Ventures International Limited has informed the Exchange regarding Board meeting held on November 14, 2019.

Corporate Actions

No Upcoming Board Meetings

Flexituff Ventures International Ltd has declared 10% dividend, ex-date: 21 Sep 15

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

76.9975

Held by 0 Schemes

Held by 0 FIIs

Kalani Industries Private Limited (11.03%)

International Finance Corporation (5.8%)

24.78%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -93.31% vs -51.98% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -51.90% vs 56.90% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -89.82% vs -51.20% in Sep 2024

Growth in half year ended Sep 2025 is -113.73% vs 502.58% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -53.02% vs -33.63% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 307.83% vs -22.67% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -51.79% vs -34.61% in Mar 2024

YoY Growth in year ended Mar 2025 is 229.57% vs -53.33% in Mar 2024