Compare G M Breweries with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

The company has declared Positive results for the last 2 consecutive quarters

With ROE of 16.6, it has a Expensive valuation with a 2.4 Price to Book Value

Increasing Participation by Institutional Investors

Market Beating Performance

Total Returns (Price + Dividend)

Latest dividend: 7.5 per share ex-dividend date: May-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

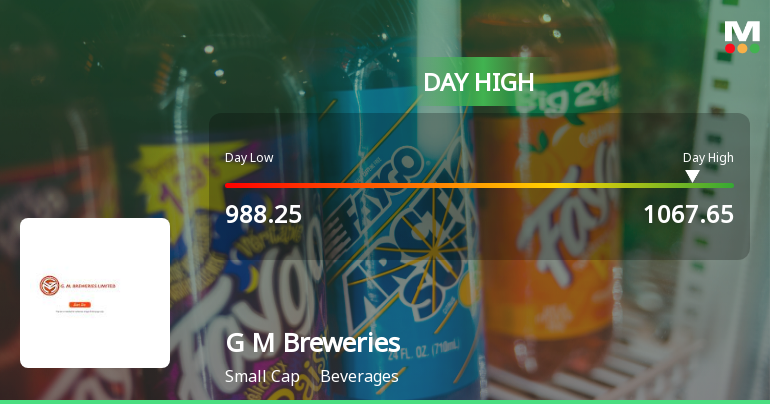

G M Breweries Ltd Hits Intraday High with 7.16% Surge on 4 Feb 2026

G M Breweries Ltd demonstrated robust intraday performance on 4 Feb 2026, surging to a day’s high of Rs 1,067.65, marking a 7.47% increase from its previous close. This strong upward movement outpaced the broader Sensex, which gained a modest 0.12% during the session.

Read full news article

G M Breweries Ltd is Rated Hold by MarketsMOJO

G M Breweries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 08 October 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 02 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

G M Breweries Ltd is Rated Hold

G M Breweries Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 08 Oct 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 22 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Outcome of EGM

05-Feb-2026 | Source : BSEOutcome of EGM

Shareholder Meeting / Postal Ballot-Scrutinizers Report

05-Feb-2026 | Source : BSEVoting Results and Scrutinizers Report

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

21-Jan-2026 | Source : BSECertificate under Regulation 74(5)

Corporate Actions

No Upcoming Board Meetings

G M Breweries Ltd has declared 75% dividend, ex-date: 22 May 25

No Splits history available

G M Breweries Ltd has announced 1:4 bonus issue, ex-date: 24 May 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 22 FIIs (1.21%)

Jimmy William Almeida Kashyap (61.76%)

None

20.07%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 11.98% vs 10.84% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 20.41% vs 34.92% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 13.93% vs 1.00% in Sep 2024

Growth in half year ended Sep 2025 is 30.34% vs 10.24% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 16.75% vs 2.60% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 49.84% vs 5.70% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 3.47% vs 3.66% in Mar 2024

YoY Growth in year ended Mar 2025 is -14.84% vs 51.72% in Mar 2024