Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.82 times

Healthy long term growth as Net Sales has grown by an annual rate of 41.02% and Operating profit at 89.40%

Flat results in Sep 25

With ROCE of 18.2, it has a Very Expensive valuation with a 4.3 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.19% of the company

Stock DNA

Iron & Steel Products

INR 14,363 Cr (Small Cap)

29.00

27

0.20%

0.12

15.87%

4.62

Total Returns (Price + Dividend)

Latest dividend: 1.2 per share ex-dividend date: Sep-12-2025

Risk Adjusted Returns v/s

Returns Beta

News

Gallantt Ispat L Sees Revision in Market Evaluation Amid Mixed Financial Signals

Gallantt Ispat L, a small-cap player in the Iron & Steel Products sector, has experienced a revision in its market evaluation reflecting nuanced changes across key financial and technical parameters. This shift highlights evolving investor perspectives amid a backdrop of strong returns and mixed quarterly results.

Read More

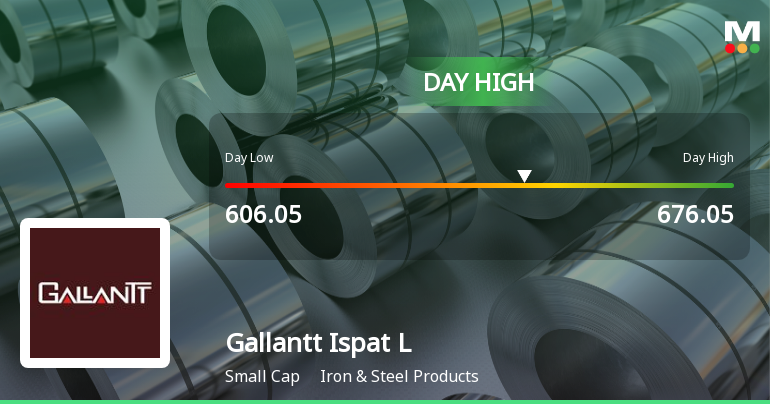

Gallantt Ispat Hits Day High with Strong 7.88% Intraday Surge

Gallantt Ispat Ltd., a small-cap company in the Iron & Steel Products sector, has demonstrated notable performance today, achieving significant gains and outperforming its sector. The stock has shown resilience amid broader market trends, with impressive returns over the past year, significantly exceeding the overall market performance.

Read MoreIs Gallantt Ispat L technically bullish or bearish?

As of 12 November 2025, the technical trend has changed from bullish to mildly bullish. The current stance is mildly bullish, primarily driven by the daily moving averages indicating mild bullishness and the weekly Dow Theory also supporting a mildly bullish outlook. However, the weekly MACD and KST are both mildly bearish, which suggests some caution. The monthly indicators, including MACD and Bollinger Bands, remain bullish, providing a stronger long-term perspective. Overall, while there are mixed signals, the prevailing trend is mildly bullish....

Read More Announcements

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

12-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Gallantt Industry Pvt Ltd & PACs

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

12-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Gallantt Industry Pvt Ltd & PACs

Announcement Under Regulation 30 Of LODR - Inter-Se Transfer Of Shares Among Promoter And Promoter Group

08-Dec-2025 | Source : BSEDisclosure of inter-se transfer of shares among the Promoter and Promoter Group pursuant Regulation 10(5) of SEBI (SAST) Regulations 2011

Corporate Actions

No Upcoming Board Meetings

Gallantt Ispat Ltd. has declared 12% dividend, ex-date: 12 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (0.06%)

Held by 11 FIIs (0.19%)

Chandra Prakash Agarwal (29.2%)

Nihon Impex Private Limited (15.02%)

10.95%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -10.20% vs 5.19% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -48.83% vs 49.42% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 1.82% vs 5.85% in Sep 2024

Growth in half year ended Sep 2025 is 53.85% vs 118.98% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 5.64% vs 3.05% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 118.86% vs 78.05% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 1.55% vs 4.20% in Mar 2024

YoY Growth in year ended Mar 2025 is 77.83% vs 59.92% in Mar 2024