Compare Gian Lifecare with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- The company has been able to generate a Return on Equity (avg) of 9.58% signifying low profitability per unit of shareholders funds

Negative results in Sep 25

Risky - Negative Operating Profits

61.17% of Promoter Shares are Pledged

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Healthcare Services

INR 11 Cr (Micro Cap)

NA (Loss Making)

56

0.00%

-0.09

-3.78%

0.57

Total Returns (Price + Dividend)

Gian Lifecare for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

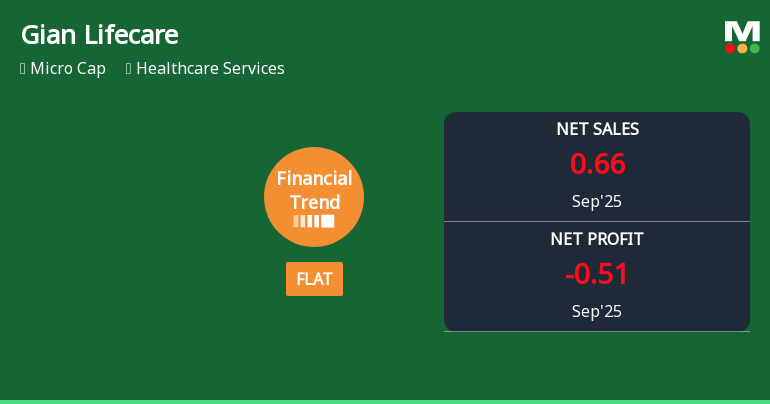

Gian Lifecare Ltd Reports Flat Quarterly Performance Amidst Financial Challenges

Gian Lifecare Ltd, a player in the Healthcare Services sector, has reported a flat financial performance for the quarter ended September 2025, signalling a pause in its previously negative trend. Despite some improvement in its financial trend score, the company continues to face significant margin pressures and operational challenges, reflected in its subdued profitability and cash flow metrics.

Read full news article

Gian Lifecare Ltd is Rated Strong Sell

Gian Lifecare Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 Sep 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Gian Lifecare Stock Falls to 52-Week Low of Rs.7.08 Amidst Continued Underperformance

Gian Lifecare’s shares touched a fresh 52-week low of Rs.7.08 today, marking a significant decline in the stock’s valuation over the past year. This new low comes amid a backdrop of persistent underperformance relative to the broader market and sector peers, reflecting ongoing concerns about the company’s financial health and valuation metrics.

Read full news article Announcements

Unaudited Standalone And Consolidated Financial Results Of The Company For The Quarter/ Half Year Ended 30Th September 2025

28-Jan-2026 | Source : BSEDear Sir/ Maam Please find attached herewith Unaudited Standalone and Consolidated Financial Results for the quarter/ half year ended September 30 2025. Kindly take the same on record. For Gian Life Care Limited

Board Meeting Outcome for Outcome Of Board Meeting Held On Wednesday January 28 2026

28-Jan-2026 | Source : BSEPursuant to the provisions of Regulation 30 and other applicable provisions of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 we are pleased to inform you that the Board of Directors at their meeting held today i.e. January 28 2026 has inter-alia considered and approved the following: - 1. Unaudited Standalone and Consolidated Financial results of the Company for the quarter/ half year ended 30th September 2025. (Copy enclosed along with Limited Review Report). The Board Meeting commenced at 04:00 P.M. and concluded at 06.00 P.M. You are requested to kindly take the above information in your records. Thanking You Yours faithfully For GIAN LIFE CARE LIMITED

Board Meeting Intimation for Rescheduling Of Board Meeting To Consider And Approve Unaudited Standalone And Consolidated Financial Results Of The Company For The Quarter/ Period Ended 30Th September 2025

24-Jan-2026 | Source : BSEGian Life Care Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/01/2026 inter alia to consider and approve As per the captioned subject it is hereby informed that the meeting of the Board of Directors of the Company which was scheduled to be held on Saturday the January 24 2026 at Kanpur has been rescheduled to be held on January 28 2026. The agenda continues to be the same which was as follows:- 1. To interallia consider and approve Unaudited Standalone and Consolidated Financial Results of the Company for the Quarter/ Period ended 30th September 2025. 2. Any other business which forms part of the Agenda Paper.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Gian Lifecare Ltd has announced 6:5 bonus issue, ex-date: 29 Mar 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

61.1684

Held by 0 Schemes

Held by 0 FIIs

Arun Kumar Gupta (29.0%)

Shield Multistate Cooperative Credit (10.57%)

54.05%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -24.14% vs -21.62% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -1,120.00% vs 108.33% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -61.07% vs -16.91% in Sep 2024

Growth in half year ended Sep 2025 is -319.05% vs -55.32% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -35.21% vs -17.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -72.28% vs 0.50% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -49.47% vs 10.07% in Mar 2024

YoY Growth in year ended Mar 2025 is -100.96% vs 291.51% in Mar 2024