Compare Globale Tessile with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate -186.13% of over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of -1.00 times

Negative results in Dec 25

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Garments & Apparels

INR 12 Cr (Micro Cap)

NA (Loss Making)

21

0.00%

0.44

-12.05%

1.06

Total Returns (Price + Dividend)

Globale Tessile for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

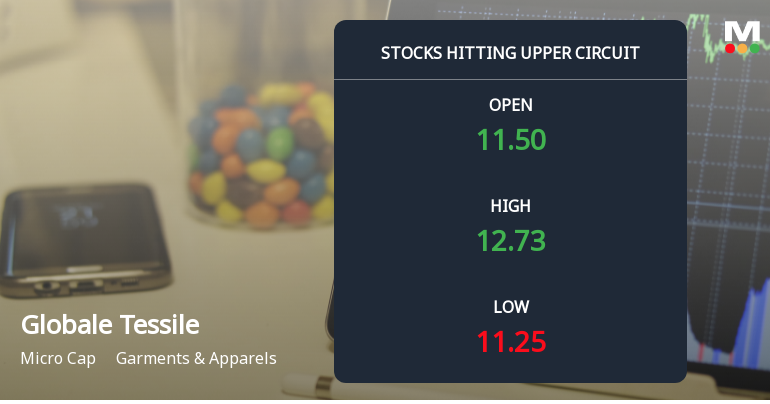

Globale Tessile Ltd Surges to Upper Circuit on Robust Buying Pressure

Shares of Globale Tessile Ltd, a micro-cap player in the Garments & Apparels sector, surged sharply on 25 Feb 2026, hitting the upper circuit limit of 13.28% to close at ₹12.37. This remarkable price action was driven by intense buying interest, resulting in a maximum permissible daily gain and a regulatory trading freeze to curb volatility.

Read full news articleAre Globale Tessile Ltd latest results good or bad?

Globale Tessile Ltd's latest financial results for Q3 FY26 indicate a company facing significant operational challenges. The net profit for the quarter was reported at a loss of ₹0.37 crores, which reflects a worsening situation compared to the previous quarter. Revenue for Q3 FY26 stood at ₹2.59 crores, marking a decline of 5.82% from the prior quarter and a substantial year-on-year decrease of 78.47%. This sharp drop in revenue signals a critical contraction in business activity, raising concerns about customer retention and operational viability. The operating margin for the quarter was recorded at -11.97%, indicating negative profitability, which is a continuation of the trend seen in the previous quarters. The company's cumulative losses over the first nine months of FY26 reached ₹0.99 crores, representing an alarming 86.85% deterioration compared to the same period last year. This trend suggests that...

Read full news article

Globale Tessile Q3 FY26: Mounting Losses Signal Deepening Crisis in Garment Manufacturer

Globale Tessile Ltd., a Gujarat-based garment and apparel manufacturer, has reported a third consecutive quarter of losses in Q3 FY26, with net profit plunging to a loss of ₹0.37 crores compared to a loss of ₹0.51 crores in Q3 FY25. The company, which commands a modest market capitalisation of ₹12.00 crores, has seen its stock price collapse by 51.06% over the past year, closing at ₹11.50 on February 12, 2026, down 5.74% on the day. The quarter's results reveal a deeply troubled business model, with revenues cratering 78.47% year-on-year to just ₹2.59 crores and operating margins remaining firmly in negative territory at -11.97%.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.07%)

Held by 1 FIIs (0.09%)

Rahul Jeetmal Parekh (17.3%)

Pritty Devi Sarawagi (1.21%)

26.22%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -5.82% vs 164.42% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -42.31% vs 27.78% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -89.61% vs 3.73% in Sep 2024

Growth in half year ended Sep 2025 is -191.18% vs -22.73% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -86.85% vs 11.09% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -682.35% vs -80.46% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -9.56% vs -19.88% in Mar 2024

YoY Growth in year ended Mar 2025 is -254.00% vs 138.76% in Mar 2024