Compare Goenka Business with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 13 Cr (Micro Cap)

29.00

23

0.00%

0.00

-9.92%

0.40

Total Returns (Price + Dividend)

Goenka Business for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Goenka Business & Finance Ltd latest results good or bad?

The latest financial results for Goenka Business & Finance Ltd reveal a complex picture characterized by significant revenue volatility and ongoing operational challenges. In Q2 FY26, the company reported a net loss of ₹1.97 crores, which represents a substantial deterioration compared to the previous quarter. Despite this, the revenue surged to ₹31.41 crores, marking a dramatic 300.13% increase quarter-on-quarter, although this figure is still down 18.90% year-on-year from ₹38.73 crores in Q2 FY25. This highlights the erratic nature of the company's income streams, suggesting instability in its business model. The operating profit before depreciation, interest, and tax (PBDIT) margin fell to 7.93%, a sharp decline from 49.04% in the prior quarter, indicating deteriorating operational efficiency. The interest costs also rose to ₹5.10 crores, which now exceeds the operating profit, raising concerns about th...

Read full news article

Goenka Business & Finance Q2 FY26: Losses Deepen Amid Revenue Volatility and Rising Interest Burden

Goenka Business & Finance Ltd., a Kolkata-based micro-cap non-banking financial company, reported a net loss of ₹1.97 crores for Q2 FY26 (Jul-Sep'25), marking a significant deterioration from the ₹0.34 crore loss in Q1 FY26 and a complete reversal from the ₹0.66 crore profit posted in Q2 FY25. The company, which carries a market capitalisation of just ₹12.00 crores and trades at ₹9.05 per share, continues to grapple with elevated interest costs that have overwhelmed its revenue generation capabilities, raising serious questions about the sustainability of its business model.

Read full news articleAre Goenka Business & Finance Ltd latest results good or bad?

Goenka Business & Finance Ltd's latest financial results for Q2 FY26 reveal significant operational challenges. The company reported net sales of ₹31.41 crores, reflecting a substantial quarter-on-quarter growth of 300.13% from ₹7.85 crores in Q1 FY26. However, this revenue spike is juxtaposed with a year-on-year decline of 18.90%, indicating volatility in sales performance. Despite the increase in sales, the company faced a net loss of ₹1.97 crores, a stark contrast to the profit of ₹0.66 crores recorded in the same quarter last year. This marks a notable deterioration in profitability, compounded by a critical decline in operating margins, which fell to 7.93% from 49.04% in the previous quarter. The operational profit, excluding other income, decreased to ₹2.49 crores, further highlighting inefficiencies. Additionally, the interest coverage ratio stands at a concerning 0.49x, suggesting that the company...

Read full news article Announcements

Board Meeting Intimation for 6Th /2025-26 Board Meeting To Be Held On 10TH February 2026.

02-Feb-2026 | Source : BSEGoenka Business & Finance Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve The Unaudited Financial Results of the Company along with Limited Review Report for the Third quarter and nine months ended on 31.12.2025.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

23-Jan-2026 | Source : BSEScrutinizers Report

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

23-Jan-2026 | Source : BSEOutcome of Postal Ballot

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Rise High Tracom Private Limited (14.91%)

Evergrowing Iron And Finvest Ltd. (9.23%)

67.07%

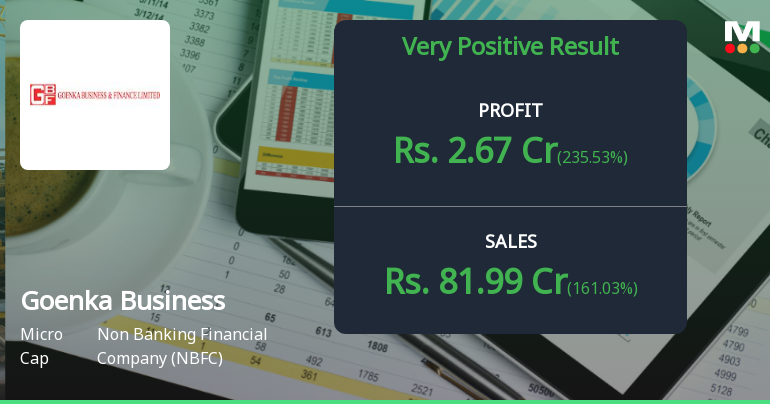

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 161.03% vs 300.13% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 235.53% vs -479.41% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -22.97% vs 6.63% in Sep 2024

Growth in half year ended Sep 2025 is -2,400.00% vs 233.33% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 99.82% vs -10.55% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 159.68% vs -144.60% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -12.72% vs -65.45% in Mar 2024

YoY Growth in year ended Mar 2025 is -126.48% vs 1,464.29% in Mar 2024