Compare Guj. Ambuja Exp with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Poor long term growth as Operating profit has grown by an annual rate -9.09% of over the last 5 years

Flat results in Dec 25

With ROE of 6.7, it has a Very Expensive valuation with a 1.9 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0.54% of the company

With its market cap of Rs 5,871 cr, it is the biggest company in the sector and constitutes 28.23% of the entire sector

Stock DNA

Other Agricultural Products

INR 5,837 Cr (Small Cap)

29.00

21

0.20%

-0.15

6.67%

1.90

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Aug-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

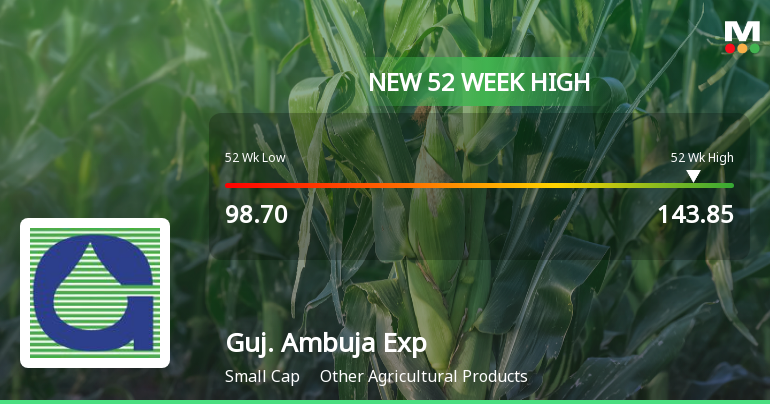

Gujarat Ambuja Exports Ltd Hits New 52-Week High at Rs.143.85

Gujarat Ambuja Exports Ltd has reached a significant milestone by hitting a new 52-week high of Rs.143.85 today, marking a notable achievement in its stock performance within the Other Agricultural Products sector.

Read full news article

Gujarat Ambuja Exports Ltd is Rated Hold

Gujarat Ambuja Exports Ltd is currently rated 'Hold' by MarketsMOJO, a rating that was last updated on 24 December 2025. While the rating change occurred on that date, the analysis and financial metrics discussed here reflect the company’s current position as of 01 February 2026, providing investors with the most up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

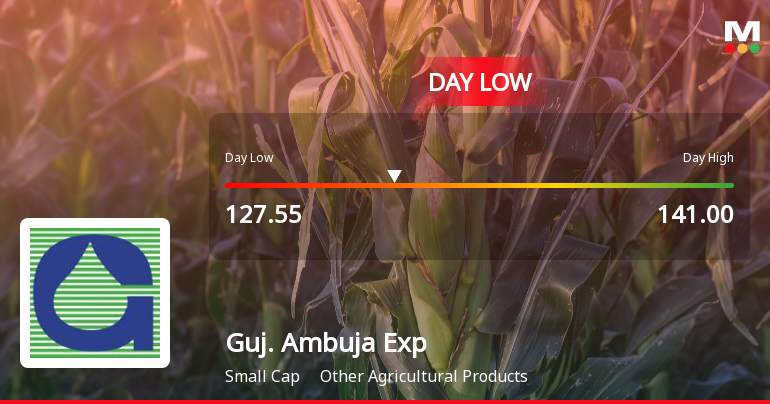

Gujarat Ambuja Exports Ltd Hits Intraday Low Amid Price Pressure

Shares of Gujarat Ambuja Exports Ltd experienced notable intraday weakness on 1 Feb 2026, touching a low of Rs 134, reflecting a decline of 4.96% from previous levels. The stock underperformed its sector and broader market indices, weighed down by persistent selling pressure and heightened volatility throughout the trading session.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSENewspaper advertisement of Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine months ended 31st December 2025

Submission Of Unaudited Standalone And Consolidated Financial Results Of The Company For The Third Quarter And Nine Months Ended 31St December 2025

30-Jan-2026 | Source : BSESubmission of Unaudited Standalone and Consolidated Financial Results of the Company for the third quarter and nine months ended 31st December 2025

Announcement under Regulation 30 (LODR)-Change in Directorate

30-Jan-2026 | Source : BSEAppointment of Additional Director designated as Whole-time Director

Corporate Actions

No Upcoming Board Meetings

Gujarat Ambuja Exports Ltd has declared 25% dividend, ex-date: 22 Aug 25

Gujarat Ambuja Exports Ltd has announced 1:2 stock split, ex-date: 01 Oct 20

Gujarat Ambuja Exports Ltd has announced 1:1 bonus issue, ex-date: 15 Mar 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 10 Schemes (0.19%)

Held by 63 FIIs (1.6%)

Manish Vijaykumar Gupta (52.4%)

None

22.02%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -0.17% vs 15.14% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 73.38% vs -41.53% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 25.41% vs -2.78% in Sep 2024

Growth in half year ended Sep 2025 is -29.44% vs -4.97% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 27.38% vs -6.54% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -22.29% vs -14.56% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -6.38% vs 0.36% in Mar 2024

YoY Growth in year ended Mar 2025 is -27.91% vs 4.77% in Mar 2024