Compare Healthy Life with Similar Stocks

Total Returns (Price + Dividend)

Healthy Life for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

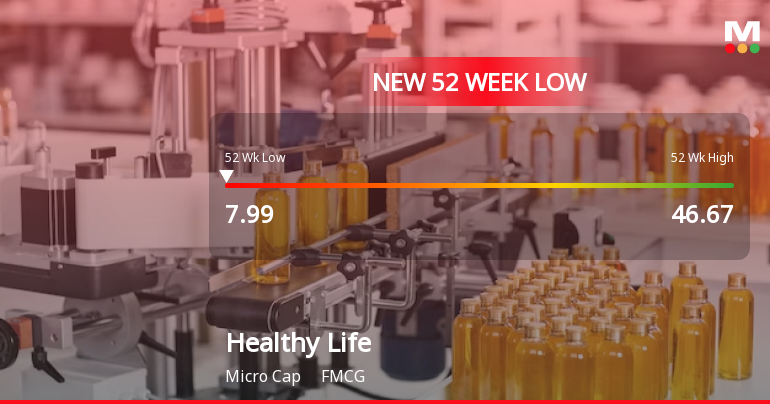

Healthy Life Agritec Ltd Stock Falls to 52-Week Low of Rs.7.99

Healthy Life Agritec Ltd’s shares declined to a fresh 52-week low of Rs.7.99 on 5 Mar 2026, marking a significant drop amid a prolonged downtrend. The stock has underperformed the broader market and its FMCG sector peers, reflecting ongoing concerns about its financial performance and valuation metrics.

Read full news article

Healthy Life Agritec Ltd is Rated Sell

Healthy Life Agritec Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 Feb 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 05 March 2026, providing investors with the most up-to-date perspective on the company’s performance and outlook.

Read full news article

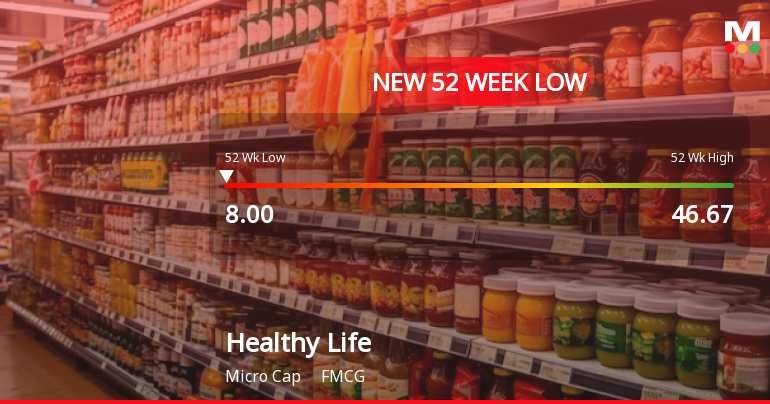

Healthy Life Agritec Ltd Stock Falls to 52-Week Low of Rs.8

Healthy Life Agritec Ltd’s shares touched a fresh 52-week low of Rs.8 today, marking a significant decline amid a sustained downward trajectory. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures on its valuation and market sentiment.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Feb-2026 | Source : BSENewspaper Advertisment regarding Publication of standalone and consolidated Unaudited Financial Results for the quarter ended 31st December2025 pursuent to regulation 30 and 47 of SEBI(Listing and Disclosure Requirment regulation2015)

Outcome Of Board Meeting Pursuant To Regulation 30 Of SEBI (Listing Obligation & Disclosure Requirements) Regulation 2015 Held On Today I.E. 14Th February 2026

14-Feb-2026 | Source : BSEPlease find attached herewith the Unaudited financial results for the quarter ended 31st December2025

Announcement under Regulation 30 (LODR)-Monitoring Agency Report

14-Feb-2026 | Source : BSEPlease find attched herewith the Monitoring Agency Report for quarter ended December2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Healthy Life Agritec Ltd has announced 1:1 rights issue, ex-date: 26 Sep 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.4%)

Cronosglobal Investment & Holding Private Limited (18.17%)

Santosh Ghosh (2.9%)

60.49%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 35.33% vs -1.92% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 230.77% vs -45.83% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.50% vs -4.67% in Mar 2025

Growth in half year ended Sep 2025 is -22.49% vs 78.63% in Mar 2025

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 2.16% vs 51.67% in Dec 2025

YoY Growth in nine months ended Dec 2025 is 18.00% vs 42.05% in Dec 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 29.27% vs 23.31% in Mar 2024

YoY Growth in year ended Mar 2025 is 29.88% vs 66.23% in Mar 2024