Stock DNA

Castings & Forgings

INR 96 Cr (Micro Cap)

14.00

35

0.00%

0.52

5.85%

0.80

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Sep-21-2015

Risk Adjusted Returns v/s

Returns Beta

News

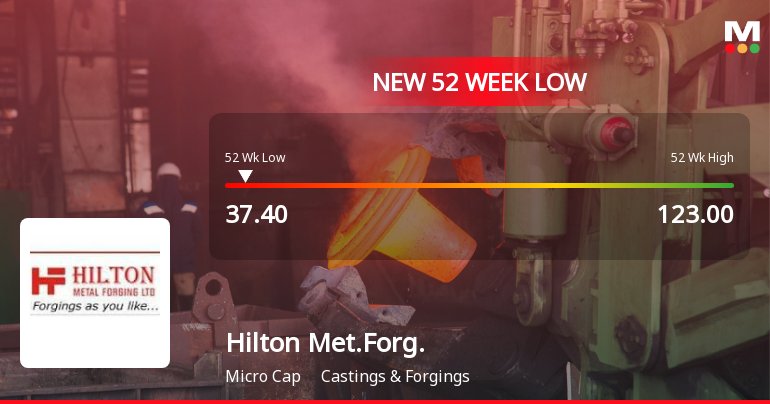

Hilton Metal Forging Falls to 52-Week Low of Rs.37.4 Amidst Market Pressures

Hilton Metal Forging touched a new 52-week low of Rs.37.4 today, marking a significant decline in its stock price over the past year. This development comes amid broader market fluctuations and specific company-related factors that have influenced its valuation within the Castings & Forgings sector.

Read More

Hilton Metal Forging Falls to 52-Week Low of Rs.37.4 Amidst Market Pressures

Hilton Metal Forging, a player in the Castings & Forgings sector, touched a new 52-week low of Rs.37.4 today, marking a significant decline in its stock price over the past year. This development comes amid broader market fluctuations and company-specific financial indicators that have influenced its valuation.

Read More

Hilton Met.Forg. Sees Revision in Market Evaluation Amid Mixed Financial Signals

Hilton Met.Forg., a microcap player in the Castings & Forgings sector, has experienced a revision in its market evaluation, reflecting nuanced shifts across key financial and technical parameters. This adjustment highlights evolving perspectives on the company’s operational quality, valuation appeal, financial trajectory, and technical positioning amid a challenging market backdrop.

Read More Announcements

Intimation Of Cancellation Of Board Meeting Pursuant To The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations).

13-Dec-2025 | Source : BSEIntimation regarding the cancellation of Board meeting to be held on Saturday 13th December 2025. Announcement is submitted under general tab due to technical error faced while uploading in tab of Board Meeting Cancellation

Board Meeting Intimation for Board Meeting To Be Held On 13/12/2025

11-Dec-2025 | Source : BSEHilton Metal Forging Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/12/2025 inter alia to consider and approve Rights Issue Related matter as per intimation attached

Closure of Trading Window

07-Dec-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Hilton Metal Forging Ltd has declared 2% dividend, ex-date: 21 Sep 15

No Splits history available

No Bonus history available

Hilton Metal Forging Ltd has announced 2:5 rights issue, ex-date: 20 Oct 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

45.613

Held by 0 Schemes

Held by 2 FIIs (0.23%)

Yuvraj Hiralal Malhotra (5.47%)

Sovereign Advisors Private Limited (2.14%)

77.52%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 297.46% vs -50.97% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 1,060.00% vs -96.69% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 41.03% vs 24.45% in Sep 2024

Growth in half year ended Sep 2025 is 57.50% vs -70.22% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 13.27% vs 40.56% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -73.13% vs 82.20% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 18.09% vs 31.71% in Mar 2024

YoY Growth in year ended Mar 2025 is -7.62% vs 14.16% in Mar 2024