Compare Hipolin with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 0%

- Poor long term growth as Operating profit has grown by an annual rate -181.14% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -1.83

Flat results in Sep 25

Risky - Negative EBITDA

Reducing Promoter Confidence

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 1.0000 per share ex-dividend date: Sep-23-2010

Risk Adjusted Returns v/s

Returns Beta

News

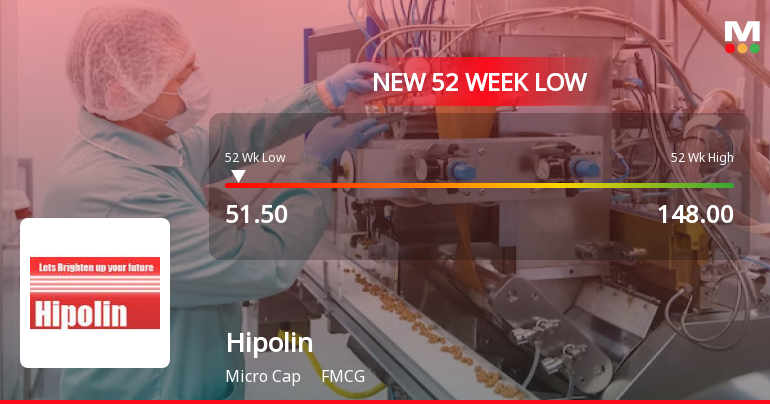

Hipolin Ltd Stock Falls to 52-Week Low of Rs.51.5 Amidst Weak Financial Metrics

Hipolin Ltd’s shares declined to a fresh 52-week low of Rs.51.5 on 29 Jan 2026, marking a significant drop amid sustained negative momentum. The stock has underperformed its sector and broader market indices, reflecting ongoing concerns about the company’s financial health and market position.

Read full news article

Hipolin Ltd is Rated Strong Sell

Hipolin Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 19 Sep 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 26 December 2025, providing investors with the latest comprehensive view of the company’s position.

Read full news article

Hipolin Stock Falls to 52-Week Low of Rs.51.55 Amidst Continued Downtrend

Shares of Hipolin, a company in the FMCG sector, touched a fresh 52-week low of Rs.51.55 today, marking a significant decline amid ongoing downward momentum. The stock has been trading below all key moving averages and has underperformed both its sector and the broader market over the past year.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

12-Jan-2026 | Source : BSEWe hereby submit certificate under Reg 74(5) of SEBI (DP) Regulation 2018 for the quarter ended 31st December 2025

Closure of Trading Window

30-Dec-2025 | Source : BSEClosure of trading window for unaudited financial results for the quarter ended 31st December2025

Disclosure Under Regulation 7(2) Of SEBI (Prohibition Of Insider Trading) Regulations 2015.

02-Dec-2025 | Source : BSEDisclosure under Regulation 7(2) of SEBI (Prohibition of Insider Trading) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Hipolin Ltd has declared 10% dividend, ex-date: 23 Sep 10

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Kinnari Vaibhav Shah (18.75%)

Dipak Kanayalal Shah (1.66%)

25.33%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -2.75% vs -25.68% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 100.00% vs 68.64% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -46.83% vs 42.37% in Sep 2024

Growth in half year ended Sep 2025 is -121.21% vs 54.79% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 23.70% vs 23.16% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -25.00% vs -109.24% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.28% vs 26.80% in Mar 2024

YoY Growth in year ended Mar 2025 is -268.54% vs -111.66% in Mar 2024