Compare Hittco Tools with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.34 times

- The company has been able to generate a Return on Capital Employed (avg) of 6.82% signifying low profitability per unit of total capital (equity and debt)

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Industrial Manufacturing

INR 7 Cr (Micro Cap)

NA (Loss Making)

28

0.00%

1.51

-12.21%

2.54

Total Returns (Price + Dividend)

Hittco Tools for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Hittco Tools Ltd latest results good or bad?

Hittco Tools Ltd's latest financial results present a complex picture characterized by significant operational challenges despite notable revenue growth. In the quarter ending September 2025, the company reported net sales of ₹2.04 crores, reflecting a year-on-year growth of 47.83% and a sequential increase of 22.16%. However, this growth has not translated into profitability, as the company continues to face persistent operating losses. The operating margin stood at -1.96%, indicating ongoing difficulties in managing costs effectively. The net loss for the same quarter was ₹0.25 crores, marking a worsening from the previous quarter's loss of ₹0.29 crores. This trend of losses has now persisted for three consecutive quarters, raising concerns about the company's ability to achieve sustainable profitability. The profit after tax (PAT) margin was reported at -12.25%, which, although an improvement from -17.3...

Read full news article

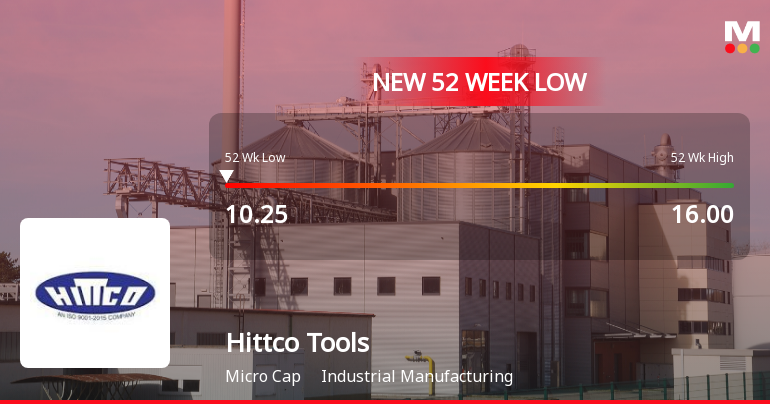

Hittco Tools Ltd Stock Falls to 52-Week Low of Rs.10.25

Hittco Tools Ltd, a player in the Industrial Manufacturing sector, touched a fresh 52-week low of Rs.10.25 today, marking a significant decline amid persistent downward momentum. The stock’s performance continues to lag behind its sector and benchmark indices, reflecting ongoing concerns about its financial health and market positioning.

Read full news article

Hittco Tools Ltd Downgraded to Strong Sell Amid Weak Financials and Bearish Technicals

Hittco Tools Ltd, a player in the industrial manufacturing sector, has seen its investment rating downgraded from Sell to Strong Sell as of 29 Dec 2025. This shift reflects deteriorating technical indicators, flat financial performance, and weak long-term fundamentals, signalling heightened risks for investors amid a challenging market environment.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

19-Feb-2026 | Source : BSEPursuant to Regulation 44(3) of SEBI LODR 2015 enclosed herewith the voting Results and Scrutinizers Report on the Postal Ballot of the Company.

Announcement under Regulation 30 (LODR)-Newspaper Publication

18-Feb-2026 | Source : BSEPursuant to Regulation 30 of SEBI LODR Regulations 2015 we hereby submit the copy of Corrigendum published in both English and Kannada Daily Newspaper.

Corrigendum To Postal Ballot Notice Dated 19.01.2026 And Corrigendum Dated 09.02.2026

17-Feb-2026 | Source : BSEPursuant to regulation 30 of LODR regulation 2015 we here with attached corrigendum to postal ballot notice dated 19.01.2026 and corrigendum dated 02.09.2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Surendra Bhandari (16.25%)

Dreambulls Partner Pvt Ltd (4.51%)

58.05%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -6.37% vs 22.16% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -4.00% vs 13.79% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 38.95% vs -12.46% in Sep 2024

Growth in half year ended Sep 2025 is 15.87% vs -1,150.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 33.18% vs -6.43% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 0.00% vs -8,000.00% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 16.42% vs -14.84% in Mar 2024

YoY Growth in year ended Mar 2025 is -105.26% vs -69.35% in Mar 2024