Compare IFB Agro Inds. with Similar Stocks

Total Returns (Price + Dividend)

IFB Agro Inds. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

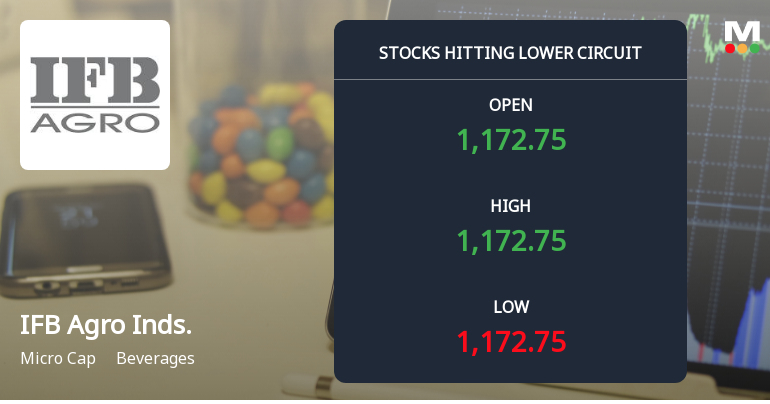

IFB Agro Industries Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Shares of IFB Agro Industries Ltd plunged to their lower circuit limit on 3 February 2026, succumbing to intense selling pressure that saw the stock lose 4.90% in a single session. The micro-cap beverage company’s shares closed at ₹1,121.5, marking a significant intraday fall amid heightened volatility and unfilled supply, signalling panic selling among investors.

Read full news article

IFB Agro Industries Ltd is Rated Hold

IFB Agro Industries Ltd is rated 'Hold' by MarketsMOJO as of the rating update on 30 January 2026. However, the analysis and financial metrics discussed below reflect the company’s current position as of 02 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

IFB Agro Industries Ltd Hits Lower Circuit Amid Heavy Selling Pressure

IFB Agro Industries Ltd, a micro-cap player in the beverages sector, witnessed a sharp decline on 2 Feb 2026, hitting its lower circuit price limit of ₹1,177.7. The stock closed with a maximum daily loss of 4.99%, reflecting intense selling pressure and panic among investors amid a four-day consecutive fall that has eroded over 12.5% of its value.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSEPursuant to Regulation 30 of SEBI Listing Regulations please find enclosed copies of newspaper clippings relating to publication of Unaudited Financial Results (Standalone & Consolidated) for the quarter and nine months ended 31st December 2025.

Disclosure Under Regulation 33 Of SEBI (Listing Obligation And Disclosure Requirements) Regulations. 2015

30-Jan-2026 | Source : BSEThe Board of Directors at its meeting held on 30th January 2026 has adopted and taken on record the Unaudited Financial Results (Standalone & Consolidated) for the quarter and nine months ended 31st December 2025 alongwith Revenue Results Assets and Liabilities of the Company pursuant to Regulation 33 of SEBI LODR Regulations 2015.

Board Meeting Intimation for Considering And To Take On Record The Unaudited Financial Results (Standalone & Consolidated) Of The Company For The Quarter And Nine Months Ended 31St December 2025

19-Jan-2026 | Source : BSEIFB Agro Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve Unaudited Financial Results (Standalone & Consolidated) of the Company for the quarter and nine months ended 31st December 2025 beside other matters.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.01%)

Held by 12 FIIs (0.93%)

Ifb Automotive Private Limited (38.46%)

Sicgil India Limited (7.67%)

22.96%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 15.85% vs 20.65% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -35.28% vs 323.37% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 30.59% vs 12.93% in Sep 2024

Growth in half year ended Sep 2025 is 282.36% vs 5,315.00% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 25.33% vs 15.57% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 117.32% vs 513.52% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 13.70% vs -25.27% in Mar 2024

YoY Growth in year ended Mar 2025 is 376.49% vs -116.45% in Mar 2024