Dashboard

Despite the size of the company, domestic mutual funds hold only 0.77% of the company

- Domestic mutual funds have capability to do in-depth on-the-ground research on companies- their small stake may signify either they are not comfortable at the price or the business

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Indian Renewable for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Indian Renewable Energy Development Agency Ltd is Rated Sell

Indian Renewable Energy Development Agency Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 24 December 2025, providing investors with an up-to-date perspective on its performance and outlook.

Read More

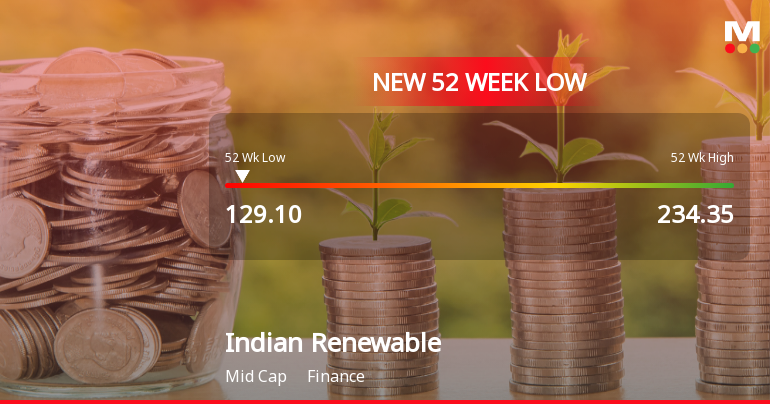

Indian Renewable Energy Development Agency Stock Hits 52-Week Low at Rs.129.1

Indian Renewable Energy Development Agency (IREDA) has reached a new 52-week low of Rs.129.1, marking a significant price level for the stock amid a broader market environment where the Sensex is trading lower. This development reflects a continuation of the stock's subdued performance over the past year.

Read More

Indian Renewable Energy Development Agency Stock Hits 52-Week Low at Rs.131.45

Indian Renewable Energy Development Agency (IREDA) has reached a new 52-week low of Rs.131.45, marking a significant decline amid a broader market environment where the Sensex showed a modest downturn. The stock has experienced a sustained downward trend over the past eight trading sessions, reflecting a cumulative return of -8.8% during this period.

Read More Announcements

Announcement under Regulation 30 (LODR)-Change in Management

09-Dec-2025 | Source : BSEChanges in the Senior Management Personnel of the Company

Intimation Of Cancellation Of The Scheduled Meeting With Analyst/ Institutional Investors In London

11-Nov-2025 | Source : BSEIntimation of Cancellation of the Scheduled Meeting with Analyst/Institutional Investor in London

Announcement under Regulation 30 (LODR)-Change in Management

10-Nov-2025 | Source : BSEIntimation under Regulation 30 of the SEBI LODR Regulations 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 20 Schemes (0.22%)

Held by 92 FIIs (1.92%)

President Of India Through Secretary Mnre (71.76%)

Life Insurance Corporation Of India (2.21%)

22.39%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 6.01% vs 2.14% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 122.56% vs -50.84% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 27.52% vs 36.09% in Sep 2024

Growth in half year ended Sep 2025 is 3.14% vs 33.16% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 35.67% vs -2.15% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 30.82% vs -4.63% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 37.22% vs 42.28% in Mar 2024

YoY Growth in year ended Mar 2025 is 35.65% vs 44.83% in Mar 2024