Compare Indiqube Spaces with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 7.78 times)- the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 27.50% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

With ROCE of 2.7, it has a Expensive valuation with a 1.7 Enterprise value to Capital Employed

Stock DNA

Diversified Commercial Services

INR 3,707 Cr (Small Cap)

NA (Loss Making)

34

0.00%

7.78

-25.37%

6.98

Total Returns (Price + Dividend)

Indiqube Spaces for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Indiqube Spaces Ltd?

The next results date for Indiqube Spaces Ltd is scheduled for 10 February 2026....

Read full news article

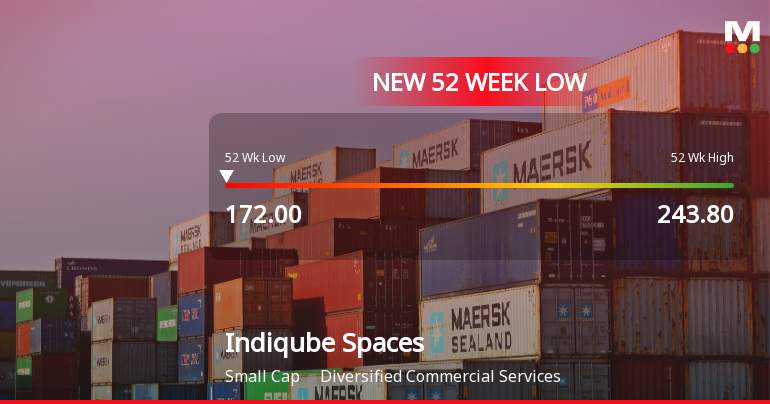

Indiqube Spaces Ltd Falls to 52-Week Low of Rs 172 Amidst Market Pressure

Indiqube Spaces Ltd’s shares declined to a fresh 52-week low of Rs.172 on 29 Jan 2026, marking a significant milestone in the stock’s recent performance as it continues to trade below all key moving averages amid a broader market downturn.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

29-Jan-2026 | Source : BSEPrior intimation on call of investors/analysts with respect to financial results for the third quarter of financial year 2025-26 scheduled on Wednesday February 11 2026 at 02:00 p.m. (IST) with the Senior Management of the Company

Board Meeting Intimation for Board Meeting Intimation For Considering And Approving The Unaudited Financial Results Of The Company For The Quarter Ended December 31 2025.

29-Jan-2026 | Source : BSEIndiqube Spaces Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Indiqube Spaces Ltd has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve the unaudited financial results of the Company for the quarter ended December 31 2025.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

12-Jan-2026 | Source : BSEIndiqube Spaces Limited has informed the Exchanges regarding a press release dated January 12 2026 titled Indiqube expands into Bhubaneshwar strengthens PAN India footprint to 17 cities.

Corporate Actions

10 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 8 Schemes (9.12%)

Held by 13 FIIs (2.3%)

Anshuman Das (21.82%)

Aravali Investment Holdings (19.14%)

2.77%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 13.21% vs 4.16% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 18.74% vs -17.33% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Standalone) - Mar'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Standalone) - Mar'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period